A Closer Look at Avaya’s Recent Developments

In the dynamic landscape of the technology industry, Avaya Holdings Corp. has been making headlines for a series of significant events that have shaped its trajectory. From legal victories to internal challenges, this Durham-based technology company has been on a transformative journey. In this blog post, we delve into the recent developments surrounding Avaya, highlighting the resolution of patent infringement lawsuits, ongoing legal battles, internal investigations, and the company’s efforts to adapt to the changing tides.

Resolving Legal Hurdles: Patent Infringement Cases

Avaya Holdings Corp. recently emerged victorious in its legal battles, specifically in the domain of patent infringement. The company successfully resolved two patent infringement lawsuits that had been looming over its operations. The first lawsuit, filed by Canadian firm Aegis Mobility in July 2022, was officially dismissed on January 13th after being “resolved.” Another legal battle, initiated by Avayla Licensing in Delaware, also reached resolution in December. These legal triumphs signify a positive step forward for Avaya as it clears legal obstacles from its path.

Shareholder Lawsuit Looms: Allegations of Deceptive Statements

However, not all legal challenges have been resolved for Avaya. The company is yet to respond to a shareholder lawsuit filed in January, which raises serious allegations. The lawsuit accuses Avaya and its executives of disseminating “materially false and misleading statements” concerning the company’s financial standing. This underscores the importance of maintaining transparency and accurate communication, particularly in the realm of financial reporting.

Internal Struggles and Leadership Changes

Beyond legal battles, Avaya has faced its share of internal struggles. A failed debt deal during the previous summer dealt a blow to the company’s financial prospects. Additionally, the company witnessed the departure of CEO Jim Chirico, followed by a change in leadership as Alan Masarek took over the reins. Furthermore, a spotlight was cast on Avaya’s financial reporting practices as an internal investigation exposed “material weaknesses.” These revelations underscore the critical role of robust financial controls and reporting integrity.

Cutting Costs and Navigating Exchange Challenges

In response to the challenges it faced, Avaya implemented cost-cutting measures, including a second round of layoffs in Europe. This strategic move aimed to streamline operations and enhance efficiency during tumultuous times. Adding to its challenges, the company received a delisting notice from the New York Stock Exchange in December, adding a layer of complexity to its financial outlook.

The Analyst Perspective: Consensus Rating and Price Targets

Amidst these developments, analysts have weighed in on Avaya’s prospects. The consensus rating for Avaya Holdings Corp. among analysts is currently “Hold,” reflecting a nuanced perspective on the company’s trajectory. Analysts have assigned a consensus price target of $8.50, with predictions spanning from $3.00 to a high of $22.00. This range of forecasts highlights the uncertainty surrounding Avaya’s future stock performance.

Conclusion: Forging Ahead in the Tech Landscape

Avaya Holdings Corp.’s recent journey exemplifies the trials and triumphs that define the tech industry. While the resolution of patent infringement lawsuits marks a step in the right direction, the ongoing shareholder lawsuit and internal challenges call for introspection and adaptation. As Avaya continues to navigate the evolving tech landscape, the lessons learned from its recent experiences will undoubtedly shape its path forward.

Latest News Bulletins

Latest News Bulletins

Avaya Holdings Corp. successfully resolves two patent infringement lawsuits, marking a legal triumph for the company.

In a legal victory, Canadian firm Aegis Mobility’s lawsuit, filed in July 2022, is dismissed on January 13th after reaching a resolution.

Avayla Licensing’s lawsuit, also alleging patent infringement, is dismissed in December following a resolution in Delaware.

Avaya faces an ongoing shareholder lawsuit, filed in January, which accuses the company and its executives of disseminating false and misleading statements regarding its financial status.

In an effort to streamline operations, Avaya implements cost-cutting measures, including employee layoffs in its European division.

Challenges mount for Avaya following a failed debt deal during the previous summer and the departure of CEO Jim Chirico.

Alan Masarek takes over as Avaya’s new CEO, succeeding Jim Chirico, while CFO Kieran McGrath retires, making way for contractor Becky Roof.

An internal investigation uncovers “material weaknesses” in Avaya’s financial reporting, underlining the need for strengthened internal controls.

Avaya receives a delisting notice from the New York Stock Exchange in December, adding complexity to its financial outlook.

Reflecting its changing dynamics, Avaya relocates its headquarters from California to Durham, North Carolina in 2020.

About Avaya

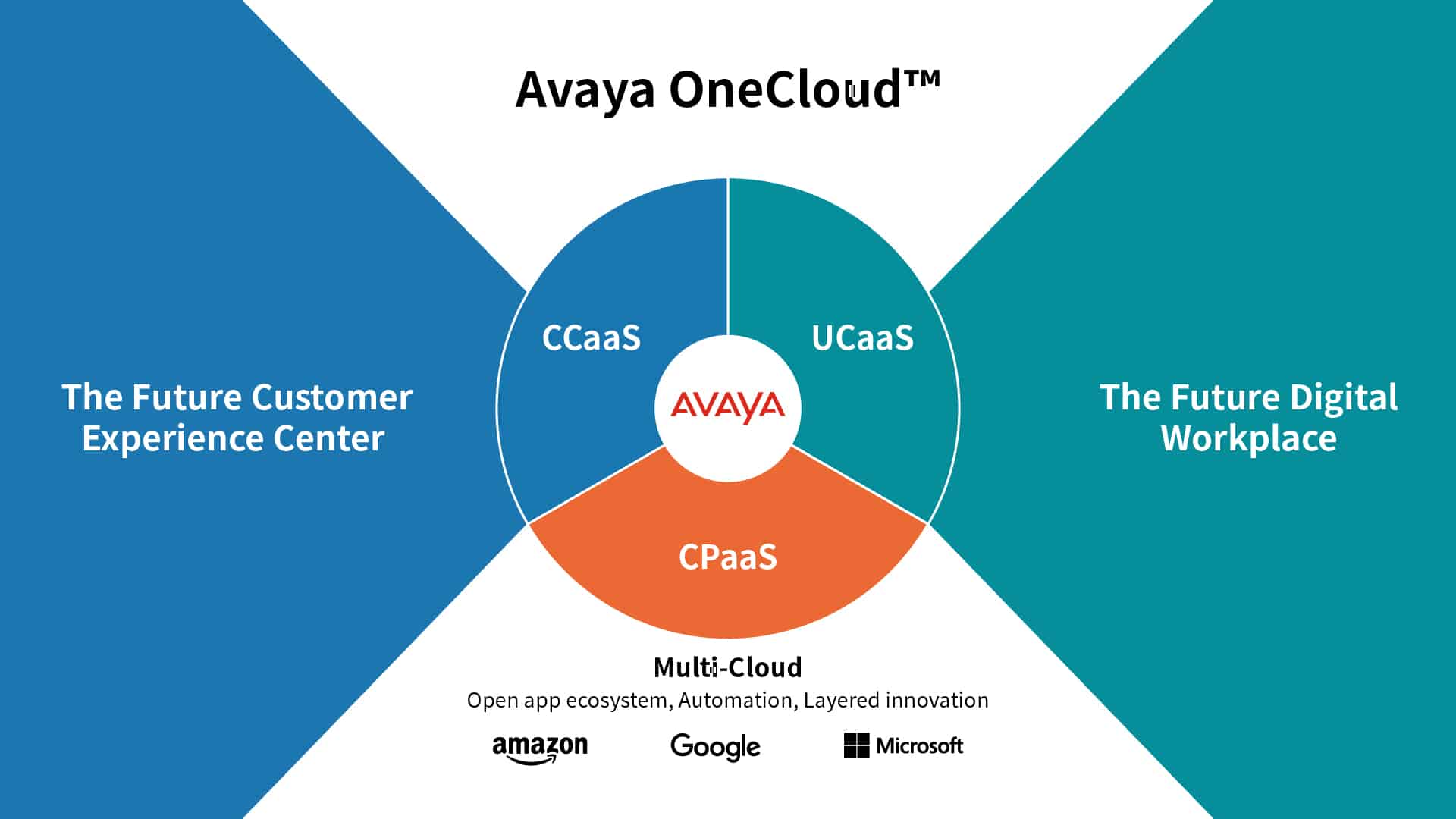

Businesses are built by the experiences they provide, and everyday millions of those experiences are delivered by Avaya Holdings Corp. (NYSE: AVYA). Avaya is shaping what’s next for the future of work, with innovation and partnerships that deliver game-changing business benefits. Our cloud communications solutions and multi-cloud application ecosystem power personalized, intelligent, and effortless customer and employee experiences to help achieve strategic ambitions and desired outcomes. Together, we are committed to help grow your business by delivering Experiences that Matter. Learn more at http://www.avaya.com.