Marathon Digital Holdings Inc.: A Roller Coaster Ride in Cryptocurrency Mining Stock

Marathon Digital Holdings Inc. is a digital asset company best known for their cryptocurrency mining. Founded in February 2010 in Las Vegas, NV, by CEO Fredrick G. Thiel, the company listed for $103. By March 2010, the company’s stock had rose to over $230. Last day of 2022 the stock closed at $3.36 increasing 8.27%.

In the past year alone, MARA’s stock price has decreased by 90.36% ($31.50), with a 52-week high of $36.00 and a 52-week low of $3.11. The stock has not been traded this low since around November of 2020.

History of Expansion and Growth

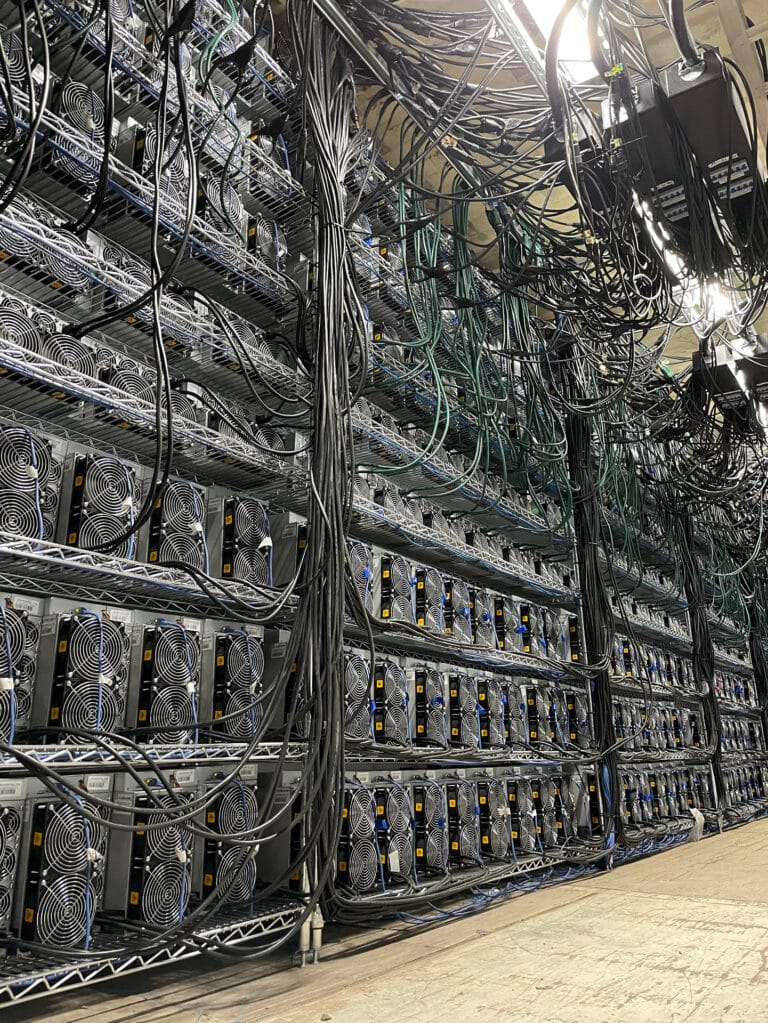

- In Q1 2020, Marathon Digital Holdings began upgrading its mining portfolio with newer miners.

- In Q2 2020, the company announced a $23 million contract with Bitmain to purchase 10,500 S19 Pro miners.

- In Q3 2020, Marathon Digital Holdings partnered with Beowulf Energy and relocated its miners to a 105 MW BTC mining data center in Montana, reducing aggregate mining costs by 38%.

- In Q4 2020, the company purchased 90,000 S19 miners, including Bitmain’s largest order ever.

- In Q1 2021, Marathon Digital Holdings successfully completed a shelf offering, increasing its cash position to $217.6 million. The company also increased its cash position to $455.1 million after a successful private placement.

- In Q1 2021, the company purchased 4,812.66 BTC at an average price of $31,168 per BTC.

- In Q1 2021, Marathon Digital Holdings began installing its first tranches of S19 miners from Bitmain and rebranded as Marathon Digital Holdings.

- In Q2 2021, the company enhanced its leadership team, including the appointment of Fred Thiel as CEO. It also began directing all hash rate to MaraPool.

- In Q2 2021, Marathon Digital Holdings announced a new agreement with Compute North to house 73,000 miners at a 300 MW facility in Texas, which will be 100% carbon neutral.

- In Q2 2021, MaraPool began signaling for Taproot.

- In Q3 2021, Marathon Digital Holdings was added to the Russell 2000 index.

- In Q3 2021, the company reported that it had installed 22,412 miners, generating 2.3 EH/s, and had produced 1,758 BTC year-to-date.

Timeline – Marathon Digital Holdings (marathondh.com)

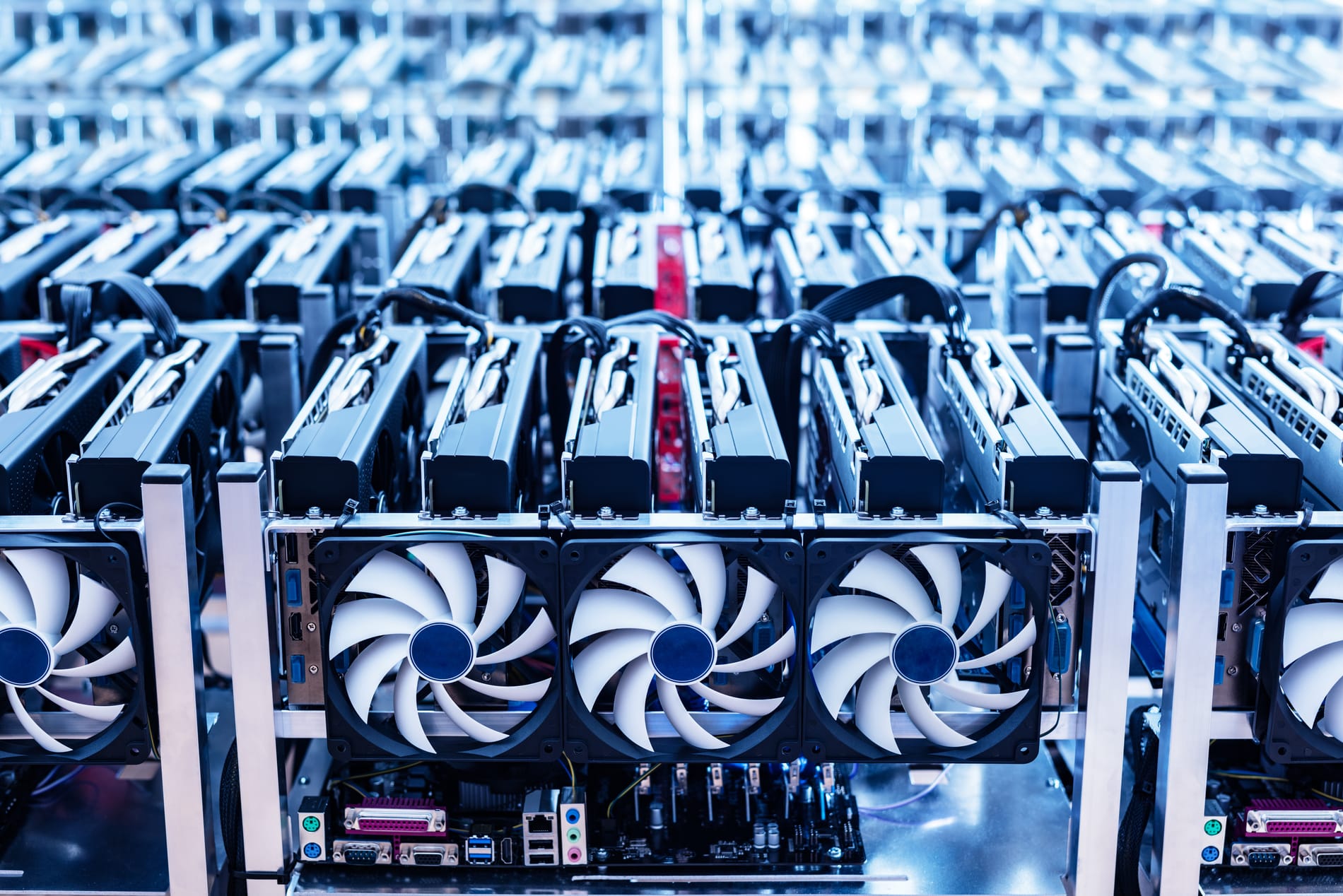

The Current Status of Bit Mining

It may have to do with crypto price. BTC is down 64.28% for the year, while ETH is down 67.04% for the year. Another reason could be the rise in energy costs in combination with falling crypto prices, make it difficult to turn a profit mining. With Ethereum 2.0, they have switched to a proof-of-stake model, making mining for ETH obsolete.

However, the company produced 472 BTC in November 2022 and 1,087 BTC Quarter-To-Date. Fred Thiel, CEO says “our monthly production increased our unrestricted bitcoin holdings from 1,950 BTC on November 9 to 4,200 BTC as of November 30, and we ended the month with $61.7 million in cash on hand.” While others may be struggling with energy efficiency, Marathon Digital claims that their new immersion pilot program, and their first 14,000 S19 XPs, are 30% more energy efficient than the prior generation of servers.

“We remain confident that Marathon is well-positioned to continue scaling into one of the largest and most energy-efficient operators in the industry.”

As of December 1, their operating mining fleet consisted of approximately 69,000 active miners, capable of producing approximately 7.0 EH/s. The company’s total bitcoin holdings increased to 11,757 BTC as of November 30, 2022.

Marathon Digital Holdings Reports Record Bitcoin Production and Expanded Mining Operations in October 2022

Marathon Digital Holdings announced record production in October 2022, with 615 BTC produced during the month. This was the company’s most productive month in terms of both hash rate growth and bitcoin production.

Marathon’s hash rate increased by 84% from approximately 3.8 exahashes per second at the end of September to approximately 7.0 exahashes per second at the beginning of November, following the energization of approximately 32,000 miners during October. As of November 1, the company’s mining fleet consisted of approximately 69,000 active miners producing approximately 7.0 EH/s. As of October 31, Marathon’s total Bitcoin holdings were worth around $231.3 million, with unrestricted Bitcoin holdings worth around $71.0 million and unrestricted cash on hand of around $52.1 million.

What is the value of MARA?

The Discounted Cash Flow (DCF) valuation model determines the company’s present value by adjusting future cash flows to the time value of money. This DCF analysis assesses the current fair value of assets or projects/companies by addressing inflation, risk, and cost of capital, analyzing the company’s future performance.

The Discounted Cash Flow (DCF) valuation model determines the company’s present value by adjusting future cash flows to the time value of money. This DCF analysis assesses the current fair value of assets or projects/companies by addressing inflation, risk, and cost of capital, analyzing the company’s future performance.

Marathon Digital Holdings is a company that is being analyzed using a two-stage discounted cash flow (DCF) model. This model takes into account the company’s growth over the next ten years and estimates its future cash flows, which are then discounted to their present value. The analysis assumes that companies with shrinking free cash flow will slow their rate of shrinkage, while those with growing free cash flow will see their growth rate slow over the period being analyzed. The DCF model is used to determine the intrinsic value of the company by considering the idea that a future dollar is less valuable than a current dollar.

The possibility of MARA’s stock price increasing is high since the stock is selling for such a low price right now, it has potential to grow. CNN analysts claim in a forecast of the next 12 months that they believe the company will have a high estimate of $22.00, a median of $17.00, and a low of $8.00. If the stock were to meet their median price prediction of $17.00, this would result in a 399.27% increase.

The possibility of MARA’s stock price increasing is high since the stock is selling for such a low price right now, it has potential to grow. CNN analysts claim in a forecast of the next 12 months that they believe the company will have a high estimate of $22.00, a median of $17.00, and a low of $8.00. If the stock were to meet their median price prediction of $17.00, this would result in a 399.27% increase.