Rather than an exciting opportunity, AMTD/HKD could be yet another “China Hustle”

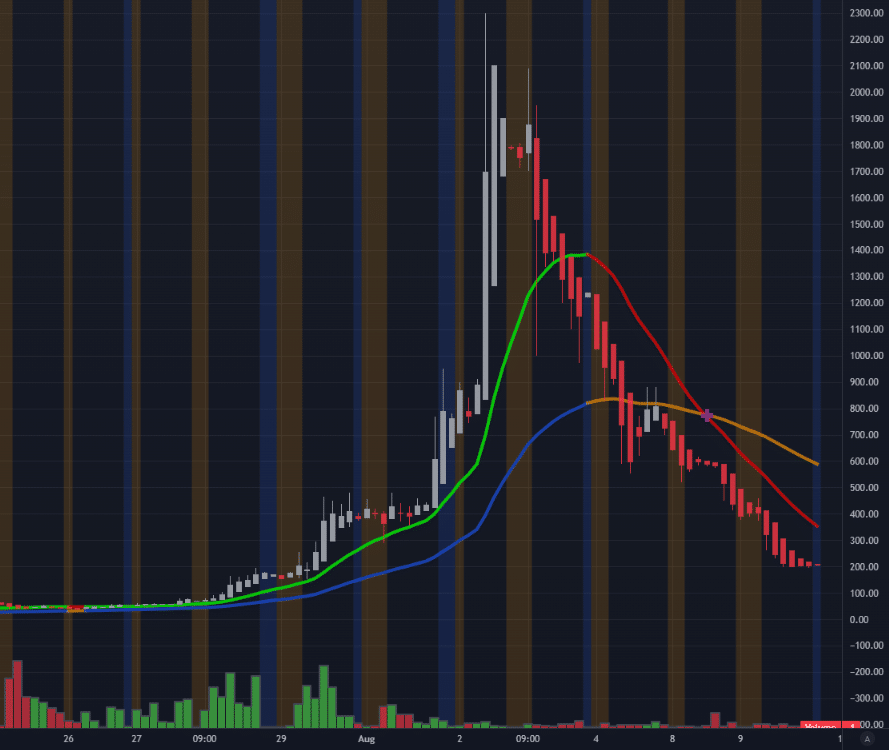

AMTD Digital (NYSE: HKD) climbed to a high of $2,555 price per share since its debut on July 15, 2022, at a price of $7.80. At its peak, the company’s market valuation dwarfed that of Facebook. The HKD IPO has been on a steady rise ever since July. In fact, AMTD Digital (NYSE: HKD) stock is still up more than 2534% since its initial public offering after falling this week more than -91%.

Is HKD yet another cautionary tale for inexperienced retail investors. Shares of HKD had fell by more than 42% during Monday’s trading session and fell another 47% on Tuesday August 9th. There’re no fundamental signs from the company that it could be worth $75 billion or an unimaginable $500 billion market cap at its peak of $2,555 price per share.

HKD finally settled some Tuesday August 9th, 2022, at the close of $205.50. Looking at the hourly chart the next main support is $175.70 leaving little room for error. A strong base range forms around $60 but there is no telling how low this could go if the company don’t boast well. Given our current information there has been no claims to support or determine a current valuation of AMTD Digital (NYSE: HKD)

![[{{{site.name}}}] New message from {{sender.name}} ‣ TradersQue CMIG](https://i0.wp.com/hindenburgresearch.com/wp-content/uploads/2021/04/AMTD.png?resize=540%2C313&ssl=1)

AMTD Digital which has a track record of fraud and self-dealings, allegations levied against it by one of the largest private equity firms in China and listings that have subsequently imploded known for underwriting for Ebang. According to media outlet Caixing Global, CMIG hung banners of AMTD Chairman Calvin Choi in Hong Kong, accusing him and his father of fraud in the months leading up to Ebang’s suspicious bond purchases.

![[{{{site.name}}}] You have been promoted in the group: "{{group.name}}" ‣ TradersQue CMIG](https://i0.wp.com/hindenburgresearch.com/wp-content/uploads/2021/04/9x.png?resize=449%2C205&ssl=1)

In the article, major Chinese private equity firm CMIG, which invested with AMTD, explained how its money essentially disappeared. According to one senior executive quoted in the article: “Some projects made money, but he didn’t give us the profits. Some had losses, but we don’t know whether he truly invested or misappropriated the money.” They vowed to “send Choi to jail” if he didn’t return their funds.

![[{{{site.name}}}] Verify your new email address ‣ TradersQue AMTD US Listings](https://i2.wp.com/hindenburgresearch.com/wp-content/uploads/2021/04/14x.png?fit=750%2C867&ssl=1)

Ebang, a Chinese base crypto company that raised $374 million us investors in 4 public offerings since IPO in June 2020. Ebang has directed $103 million total in the bond purchases linked to the US. The initial IPO proceeds were 92 million, Representing 11 million more than its entire IPO proceeds. The company ultimately failed to list in Hong Kong, twice, owing to customer lawsuits, police investigations relating to embezzlement and other fraud allegations, and public scrutiny over its conduct.

AMTD has entered into similar bond transactions in the past. AMTD took Molecular Data public in early 2020 that company was also down 70% in a short time. Since its IPO the co-founder and six board members have resigned. Despite the bull run, 87% of AMTD’s U.S underwritten IPOs have resulted in substantial losses for investors. Within about 2 years from listing, AMTD’s U.S. IPOs have plummeted a median 48.7% and an average of 34%.

Can HKD be considered a meme stock or is HKD just another China based insider’s enrichment scheme which has signaled to investors the party is over. From this point of view buyers since August or in turmoil, those who remain holding since IPO are hanging on by a thread. Those who sold for gains and likely insiders struck it rich in AMTD Digital once again. Rather than an exciting opportunity, HKD could be yet another “China Hustle” the latest in a long list of companies blatantly absconding with U.S. capital, which winds up taking a one-way trip to China as a result of misrepresentations to U.S. investors.

HKD – AMTD Digital Inc. | Overview | OTC Markets

Want to see more articles like this?

Blog Index – TradersQue – Market coverage with direct focus on microcaps