🌟 Welcome to TraderQue’s OTC Watchlist! 🌟

Welcome to our week 16 update and thank you for your continued engagement. As we review the standout moments from previous weeks, our focus remains on uncovering stocks that, while perhaps overlooked, present promising growth opportunities or noteworthy market activity. This is essential for both seasoned investors and those new to the OTC markets.

We’re also excited to announce a new feature each week on X.com: a community-driven poll. It seems this week’s voting is piling up, with interest to reduce the list to less than 50 tickers. Earlier this week we polled a few tickers to remove due to low average volume. The community spoke and all (3), CSTF, NTAC, INLB have been unlisted. We encourage you to participate and help shape our watchlist by reviewing a carefully selected mix of OTC stocks, analyzed for both recent results and significant news impacts.

Stay sharp and ahead of the curve with our insights and community-driven watchlist. Grab the list here 👉 OTC Community Watchlist – TradingView

Week 16: April 15th – 19th

As we proceed, remember that investing in the OTC market carries its unique risks and opportunities. We’re here to provide insights, but we encourage doing your due diligence and considering your investment strategy. Welcome to our community, and let’s start the journey.

💥 Top Performers 💥

DUTV – Digital Utilities Ventures, Inc. (OTCPK)

Weekly Highlight: This week’s top performer with a move of 152%

Closing Price: $.0095 with recent 52 week high of $.0133

Volume Buzz: 2 consecutive days of volume above 4.5M shares. Traded above 10-day average volume of 664K.

Why Watch: Digital Utilities Ventures, Inc. completed a major acquisition, gaining a majority interest in Easy Energy Systems Technologies and Easy Modular Manufacturing. Multiple 8-Ks have been posted, DUTV – Digital Utilities Ventures, Inc. | Disclosure | OTC Markets

RDGL– Vivos Inc. (OTCQB)

Weekly Highlight: 4 consecutive weeks listed as a top performer with a move of +1.53% for week 16. Makes our solid 2nd position not for gains but the continued support the share price has ahead of major catalysts stated for the future of cancer treatments.

Closing Price: $.1060 +1.53% for the week with a recent weekly high of $.1148

Volume Buzz: 1.3M shares traded above 10-day average volume of 924K.

Why Watch: Anticipation of potential new IsoPet clinics and Company confirmed IDE submission final details, Q1 report is being finalized and New Vivos website

Weekly Highlight: Featured by @ToddAnalytics in both articles and podcasts since 2023. BioLargo price has moved over 100% in 2024 since our initial coverage.

Closing Price: $.3396 +18.59% from this week’s lows

Volume Buzz: daily avg volume holding above 225k shares this week.

Why Watch: BioLargo PFAS Removal Technology Meets New US Drinking Water Standards

Honorable mentions:

GGSM+14.2%

SPZI+16.9%

SDRC+34.7%

🌟 Screener Highlight of the Week 🌟

Dive into this week’s featured selections from our proprietary screener – where numbers meet intuition. Discover the gems that are shining a bit brighter than the rest.

📈 Criteria Breakdown 📈

Our screener this week zeroes in on stocks with significant price changes, those witnessing unusual trading volumes, entities getting attention in media or social platforms, and companies with noteworthy financial health disclosures. Explore these criteria for potential highlights.

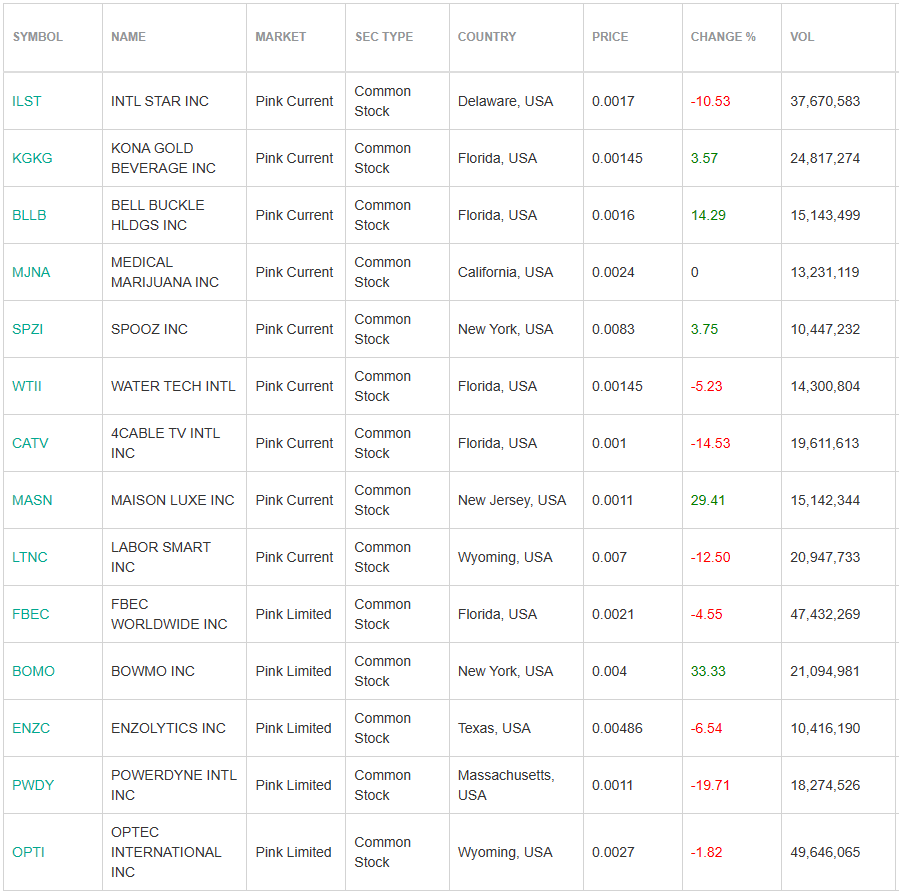

- Price Movements: Stocks with the highest percentage increase/decrease.

- Volume Surges: Companies experiencing unusual trading volume.

- Market Sentiment: Stocks buzzing on social media or news outlets.

- Financial Health Flags: Highlighting companies with recent positive/negative financial disclosures.

🌟 Emerging Opportunities 🌟

Highlighting stocks with promising trends or news that may influence their future success. Our selection of emerging microcap stocks spans various sectors, demonstrating the wealth of opportunities for investors. Below are some notable emerging stocks for consideration. While not all have reached our community watchlist, our commitment is to provide a comprehensive range of microcap investment opportunities to our readers.

- Therma Bright Inc. (TBRIF) – Specializing in medical technology, Therma Bright focuses on innovative solutions such as the Digital Cough Analyzer, which utilizes AI to analyze cough sounds with high accuracy. Their range of products addresses various healthcare needs, from pain relief to preventing deep vein thrombosis (MarketScreener).

- Ludwig Enterprises (LUDG) – Positioned in the biotechnology sector, Ludwig Enterprises concentrates on genomic technology with a proprietary methodology that could detect biomarkers for serious diseases. This tech is aimed at transforming how diseases like cancer and diabetes are detected and managed (PubCo Insight).

- iQSTEL Inc. (IQST) – iQSTEL offers a diverse range of services including VoIP, IoT solutions, and fintech services, with operations spread across 19 countries. They are actively expanding into the electric vehicle market, reflecting their broad technological engagement (PubCo Insight).

- Endexx Corporation (EDXC) – Endexx develops and distributes all-natural CBD products aimed at therapeutic and pain relief for both humans and pets, leveraging years of clinical research to ensure effective dosage and delivery (PubCo Insight).

- MetAlert (MLRT) – Specializing in GPS/BLE wearable technology, MetAlert addresses the needs of patients with cognitive and spatial awareness disorders. Their products, like the GPS SmartSole®, offer innovative solutions for tracking and monitoring vulnerable individuals in real-time (PubCo Insight).

📊 Market Trends 📊

For Week 16, the OTC markets saw a subdued performance across several key metrics, potentially reflecting a broader slowdown in market activity. A total of 12,457 securities were traded, indicating some stability but also hinting at possible caution among investors.

The total average dollar volume was notably lower, at approximately $1.6 billion, suggesting a decrease in investor engagement and a potential tightening of capital flow within the OTC markets.

Similarly, the share volume reached just 2.8 billion average shares, pointing to reduced liquidity compared to previous periods. This decrease in trading volume might signify a cautious approach from investors, possibly due to broader market uncertainties.

The week ended with only 158,650 average trades per day, a number that underscores a less active trading environment. This lower level of activity could be an indicator of wider market effects impacting investor confidence and participation in the OTC markets.

💬 Your Thoughts? 💬

Week 16 marked a quieter period in the OTC markets, reflecting broader trends of reduced volume and capital flow. Despite the overall slowdown, the markets still harbored noteworthy opportunities among the wide array of securities traded.

This trend of decreased activity could be an important indicator of market sentiment, suggesting that investors are becoming more selective amidst growing uncertainties. However, this environment also emphasizes the potential for uncovering hidden gems in the OTC space, which often escapes the radar of mainstream investment channels.

The need for thorough research and prudent risk management becomes even more crucial under such market conditions. Investors are reminded that while opportunities exist, they come with the necessity for careful strategic consideration to navigate the less regulated and inherently riskier OTC markets effectively. This careful approach can lead to discovering valuable investments even in times of overall market pullback.

Missed Week 14’s insights? Catch up here to stay ahead in the market.

Week 15 in Review – OTC Watchlist ‣ TradersQue

We love hearing from our readers! What are your predictions for next week? Any stocks you’re keeping an eye on? Share your thoughts and let’s engage in the world of OTC stocks together. Join us on X.com