🌟 Welcome to TraderQue’s OTC Watchlist! 🌟

Thank you for joining us as we explore week 14 highlights from OTC market. Our goal is to highlight stocks that might not be on every investor’s radar but show potential for growth or interesting activity. Whether you’re seasoned in navigating the OTC waters or just dipping your toes in, we believe there’s value in watching these companies.

This week, we’ll guide you through a selection of OTC stocks that we’ve found noteworthy. Our focus is on providing a balanced view, incorporating both performance data and news that could influence these stocks’ future.

Stay ahead with our community watchlist and insights!

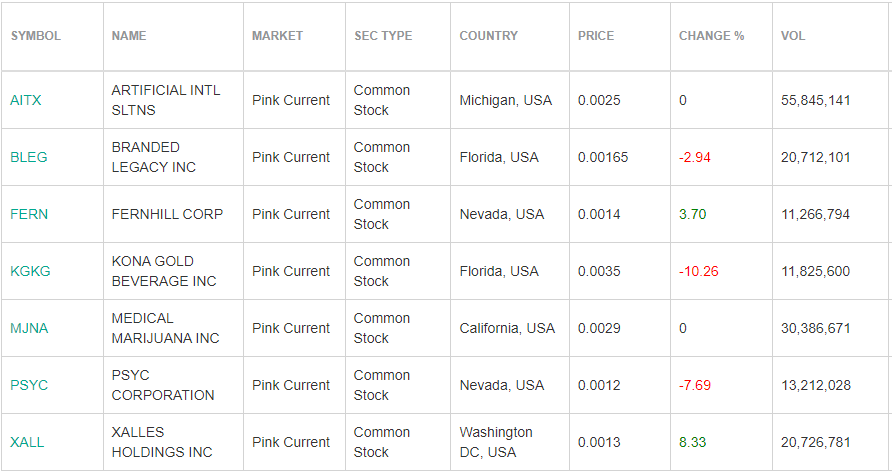

OTC Community Watchlist – TradingView

Week 14: April 1st – 5th

As we proceed, remember that investing in the OTC market carries its unique risks and opportunities. We’re here to provide insights, but we encourage doing your due diligence and considering your investment strategy. Welcome to our community, and let’s start the journey.

💥 Top Performers 💥

FLES – Auto Parts 4Less Group Inc.

Weekly Highlight: Solid move over 80% for week 14

Closing Price: $.054

Volume Buzz: daily average volume of 484k shares this week.

Why Watch: Low Float, Volatility, 8k in March the Company issued shares in exchange for indebtedness owed to Brown in an Agreement, for all corporate purposes to have been cancelled.

BLEG – Branded Legacy Inc.

Weekly Highlight: Solid move Friday of 42.4% for week 14

Closing Price: $.0024

Volume Buzz: daily average volume of 26 million shares this week.

Why Watch: Branded Legacy, Inc Announces White Label Deal with Kava & Hobbs, LLC for Kava Vape formulation NT-10K Filing – 04/01/2024 we anticipate submitting the report on or before the revised deadline of 04/16/2024

SDRC – Sidney Resources Corp.

Weekly Highlight: Solid move of +9% for week 14

Closing Price: $.349

Volume Buzz: Below Average

Why Watch: Social Buzz on #GOLD values – with production ready gold mines estimated around 225,000 tons of gold valued between $114 million and $1.5 billion. Longterm Stability.

RDGL– Vivos Inc.

Weekly Highlight: Solid move of 11.73% for week 14

Closing Price: $.08

Volume Buzz: Above 10-day average volume

Why Watch: Company confirmed IDE submission final details, Q1 report is being finalized and New Vivos website Today! 04/05/24

Honorable mentions:

EARI+67%

IGPK+52%

LTNC +244%

AHRO+33%

DUTV+30%

🌟 Screener Highlight of the Week 🌟

Dive into this week’s featured selections from our proprietary screener – where numbers meet intuition. Discover the gems that are shining a bit brighter than the rest.

📈 Criteria Breakdown 📈

Our screener this week zeroes in on stocks with significant price changes, those witnessing unusual trading volumes, entities getting attention in media or social platforms, and companies with noteworthy financial health disclosures. Explore these criteria for potential highlights.

- Price Movements: Stocks with the highest percentage increase/decrease.

- Volume Surges: Companies experiencing unusual trading volume.

- Market Sentiment: Stocks buzzing on social media or news outlets.

- Financial Health Flags: Highlighting companies with recent positive/negative financial disclosures.

🌟 Emerging Opportunities 🌟

Highlighting stocks with promising trends or news that may influence their future success. Our selection of emerging microcap stocks spans various sectors, demonstrating the wealth of opportunities for investors. Below are some notable emerging stocks for consideration. While not all have reached our community watchlist, our commitment is to provide a comprehensive range of microcap investment opportunities to our readers.

Ardelyx Inc. (NASDAQ: ARDX) has gained attention with its FDA-approved drugs for irritable bowel syndrome and kidney disease, despite a net loss and investor concerns over trial data (Yahoo Finance).

Savara Inc. (NASDAQ: SVRA) focuses on rare respiratory disease treatments, with significant regulatory endorsements for its drug candidate molgramostim (Yahoo Finance).

Iovance Biotherapeutics Inc. (NASDAQ: IOVA) targets solid tumor cancers and has garnered analyst optimism despite profitability challenges (Yahoo Finance).

iQIYI Inc. (NASDAQ: IQ), a leader in Asian streaming content, shows promising trends towards profitability amidst market performance concerns (Yahoo Finance).

Elite Pharmaceuticals (OTCMKTS: ELTP) has potential in the pharmaceutical sector with a focus on generic drugs, especially after filing a new drug application for a generic antimetabolite (Yahoo Finance).

Exro Technologies (OTCMKTS: EXROF) stands out in the electric vehicle (EV) and battery systems sector, showing promise despite previous stock performance dips (Yahoo Finance).

MariMed (OTCMKTS: MRMD), an integrated cannabis company, is highlighted for its profitability and potential as an acquisition candidate should cannabis become federally legal in the U.S (Yahoo Finance).

NewLake Capital Partners (OTCMKTS: NLCP) operates as a cannabis-focused real estate investment trust (REIT), offering a unique angle on the cannabis market (Yahoo Finance).

BAE Systems (OTCMKTS: BAESY), a major defense contractor, derives substantial revenue from outside its home market, with growth potential tied to global defense spending (InvestorPlace).

Sberbank of Russia (OTCMKTS: SBRCY), Russia’s largest bank, shows robust revenue growth and a substantial dividend yield, offering an interesting prospect for those willing to navigate geopolitical risks (InvestorPlace).

Softbank (OTCMKTS: SFTBY) invests in major tech entities globally, likened to a mutual fund with a diversified tech portfolio (InvestorPlace).

Tencent (OTCMKTS: TCEHY), a massive conglomerate, impacts various sectors including internet, social networking, gaming, and more, with significant growth and a large market cap (InvestorPlace).

Epazz Inc. (OTC: EPAZ) focuses on mission-critical technologies including drone technology and blockchain apps. It recently formed a subsidiary for battery technology, aiming to revolutionize the sector (MarketScreener).

Cyberlux Corporation (OTC: CYBL), transitioning to a digital technology platform company, has seen revenue growth from its diversified business lines (Insider Financial).

📊 Market Trends 📊

In week 14, the OTC markets showed notable activity, with a total of 12,443 securities being traded. This figure suggests a diverse and active marketplace, where investors have a wide array of options for their investment strategies, from emerging technologies to traditional industries.

The daily average dollar volume of transactions amounted to $2.2 billion. An increase from week 13 of $1.9B indicating substantial financial engagement within the OTC market. This level of dollar volume reflects investor confidence and the significant capital flow through these markets, despite the inherent risks associated with OTC trading.

The steady daily average share volume reached an impressive 4.0 billion, a testament to the high level of liquidity and trading activity. Such a vast number of shares being traded can be indicative of both speculative trading and strategic positioning by investors seeking to capitalize on undervalued assets or emerging growth companies.

With more than 247,000 trades executed on average, the market demonstrated a robust trading environment. This high number of trades highlights the dynamic nature of the OTC markets, where both retail and institutional investors are active participants. The breadth of trading activity underscores the critical role that the OTC markets play in providing access to capital and liquidity for companies that are not listed on traditional exchanges.

💬 Your Thoughts? 💬

Week 14 in the OTC markets was marked by medium trading activity, substantial financial engagement, and a broad spectrum of participating securities. The data points to more growth in money flow and investor interest in the OTC space. However, investors are reminded of the need for diligent research and risk management when navigating these less regulated markets.

Missed Week 13’s insights? Catch up here to stay ahead in the market.

We love hearing from our readers! What are your predictions for next week? Any stocks you’re keeping an eye on? Share your thoughts and let’s engage in the world of OTC stocks together. Join us on X.com