🌟 Welcome to TraderQue’s OTC Watchlist! 🌟

Thank you for joining us this week as we explore the OTC market. Our goal is to highlight stocks that might not be on every investor’s radar but show potential for growth or interesting activity. Whether you’re seasoned in navigating the OTC waters or just dipping your toes in, we believe there’s value in watching these companies.

This week, we’ll guide you through a selection of OTC stocks that we’ve found noteworthy. Our focus is on providing a balanced view, incorporating both performance data and news that could influence these stocks’ future.

Stay ahead with our community watchlist and insights!

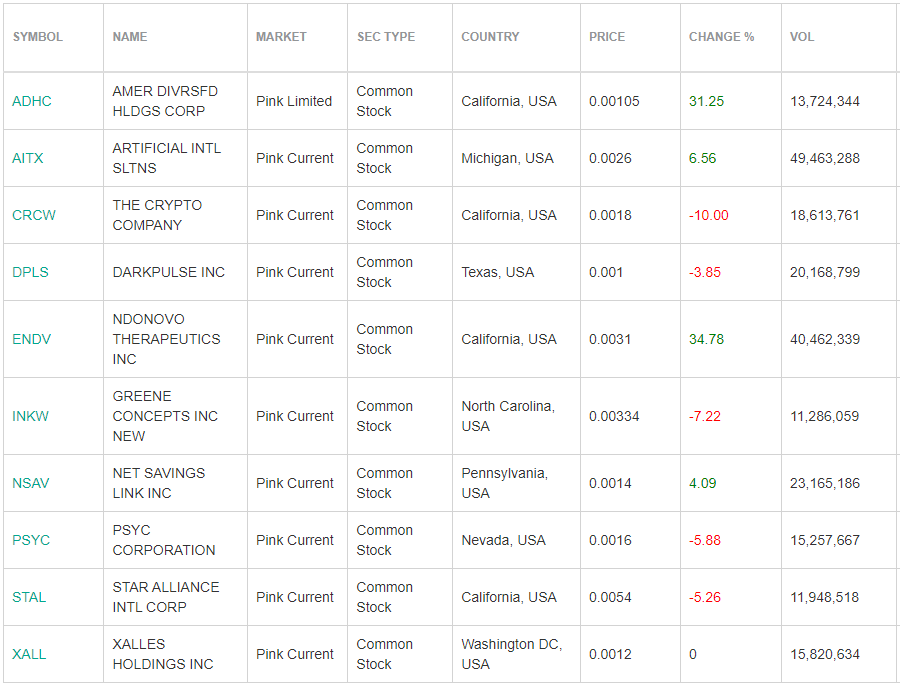

OTC Community Watchlist – TradingView

Week 13: March 25th – 29th

As we proceed, remember that investing in the OTC market carries its unique risks and opportunities. We’re here to provide insights, but we encourage doing your due diligence and considering your investment strategy. Welcome to our community, and let’s start the journey.

💥 Top Performers 💥

HYSR – SunHydrogen Inc.

Weekly Highlight: Solid move over 43% for week 13

Closing Price: $.0161

Volume Buzz: daily average volume of 11 million shares this week.

Why Watch: Organic Chart setup

PWDY – Powerdyne International, Inc.

Weekly Highlight: Solid move over 233% for week 13

Closing Price: $.0022

Volume Buzz: daily average volume of 26 million shares this week.

Why Watch: Filing – PRE 14C – 03/26/2024

OPTI – Optec International, Inc.

Weekly Highlight: Solid move of 75% for week 13

Closing Price: $.0042

Volume Buzz: daily average volume of 30 million shares this week.

Why Watch: Social chatter but no clear reason, max OS could be concerning.

Honorable mentions:

ENDV +34%

CSFT +40%

LTNC +42%

FCGD +33%

ITNS +200%

🌟 Screener Highlight of the Week 🌟

Dive into this week’s featured selections from our proprietary screener – where numbers meet intuition. Discover the gems that are shining a bit brighter than the rest.

📈 Criteria Breakdown 📈

Our screener this week zeroes in on stocks with significant price changes, those witnessing unusual trading volumes, entities getting attention in media or social platforms, and companies with noteworthy financial health disclosures. Explore these criteria for potential highlights.

- Price Movements: Stocks with the highest percentage increase/decrease.

- Volume Surges: Companies experiencing unusual trading volume.

- Market Sentiment: Stocks buzzing on social media or news outlets.

- Financial Health Flags: Highlighting companies with recent positive/negative financial disclosures.

🌟 Emerging Opportunities 🌟

Spotlight on stocks that have shown promising movements or news that could impact future performances.

RDGL – Vivos Inc.

Potential Catalysts: The FDA’s Breakthrough Device Designation for Vivos Inc.’s RadioGel Therapy could significantly impact its growth, signaling a potential acceleration in the treatment’s development and market introduction.

XALL – Xalles Holdings

Potential Catalysts: Xalles Holdings acquired CashXAI Inc., enhancing its fintech offerings, especially for unbanked communities. CashXAI’s network and mobile app simplify cash to digital currency conversions. The company operates in Mexico and the US, with expansion plans into Africa, the Middle East, and Asia.

Later this week expect a deep dive into recent hints about ArtemisX, which specializes in advanced autonomous technologies for Defense and Homeland Security and plans to expand its influence in the USA, contributing to major defense initiatives.

DDDX – 3DX Industries Inc.

Potential Catalysts: DDDX has a tight share structure with 52.3M unrestricted shares, indicating a micro float that could lead to high volatility.

3DX Industries’ push to partner with Fortune 500 and tech-focused companies, targeting aerospace, technology, and marine sectors is showing promise. Their initiative is attracting significant manufacturers, leading to discussions for potential manufacturing projects and job quotes, highlighting a successful outreach strategy.

ENDV – Endonovo Therapeutics, Inc.

Potential Catalysts: Endonovo and its subsidiary, SofPulse, Inc., have completed their Asset Purchase Agreement from December 2023, with SofPulse acquiring Endonovo’s assets and IP for at least $50 million. This finalizes the spin-off terms, pending regulatory approval, aligning both entities towards shared long-term growth objectives.

📊 Market Trends 📊

In week 13, the OTC markets showed notable activity, with a total of 12,446 securities being traded. This figure suggests a diverse and active marketplace, where investors have a wide array of options for their investment strategies, from emerging technologies to traditional industries.

The daily average dollar volume of transactions amounted to $1.9 billion, indicating substantial financial engagement within the OTC market. This level of dollar volume reflects investor confidence and the significant capital flow through these markets, despite the inherent risks associated with OTC trading.

The steady daily average share volume reached an impressive 4.9 billion, a testament to the high level of liquidity and trading activity. Such a vast number of shares being traded can be indicative of both speculative trading and strategic positioning by investors seeking to capitalize on undervalued assets or emerging growth companies.

With more than 276,000 trades executed on average, the market demonstrated a robust trading environment. This high number of trades highlights the dynamic nature of the OTC markets, where both retail and institutional investors are active participants. The breadth of trading activity underscores the critical role that the OTC markets play in providing access to capital and liquidity for companies that are not listed on traditional exchanges.

💬 Your Thoughts? 💬

Week 13 in the OTC markets was marked by vigorous trading activity, substantial financial engagement, and a broad spectrum of participating securities. The data points to a healthy level of investor interest and activity in the OTC space, driven by diverse investment opportunities and the potential for significant returns. However, investors are reminded of the need for diligent research and risk management when navigating these less regulated markets.

We love hearing from our readers! What are your predictions for next week? Any stocks you’re keeping an eye on? Share your thoughts and let’s engage in the world of OTC stocks together.