🌟 Welcome to TraderQue’s OTC Watchlist! 🌟

Thank you for joining us as we dive into the highlights from week 15. Our mission is to spotlight stocks that might not make every investor’s list but offer potential growth or notable activity. Whether you’re a veteran of the OTC scene or just starting out, there’s value in keeping an eye on these dynamic companies.

This week, we’re excited to introduce a new feature on X.com: a poll that lets you help shape our community watchlist. We’ll walk you through a curated selection of OTC stocks, presenting a balanced perspective based on both recent performances and influential news.

Stay sharp and ahead of the curve with our insights and community-driven watchlist. OTC Community Watchlist – TradingView

Week 15: April 8th – 12th

As we proceed, remember that investing in the OTC market carries its unique risks and opportunities. We’re here to provide insights, but we encourage doing your due diligence and considering your investment strategy. Welcome to our community, and let’s start the journey.

Week 15 Poll results

RWGI – Rodedawg Intl. Ind, Inc.

Weekly Highlight: Price has been stable above $0.03

Closing Price: $0.0345 (-11.41%)

Volume Buzz: Above avg volume this week.

Why Watch: Rodedawg Intl. Ind, Inc. (OTC: RWGI) Accelerates Revenues with Hemp and Cannabis Derived Isolates Sales & Manufacturing

Rodedawg Intl. Ind, Inc. (OTC: RWGI) Signs Exclusive Distribution Agreement with D9, LLC

Rodedawg Intl. Ind, Inc. (OTC: RWGI) Provides Shareholder Update and Begins Revenue Growth Curve

RWGI is a premier management and consulting firm in the regulated California cannabis market, serving dispensaries, manufacturers, distributors, and delivery services. We launch and enhance proprietary brands through our robust network and unique Manage-to-Own process, ensuring the growth of our investments. Budding Horizon, LLC

💥 Top Performers 💥

RDGL– Vivos Inc. (OTCQB)

Weekly Highlight: 3 consecutive weeks as a top performer with a move of 11.73% for week 14 and additional 33.33% increase in week 15.

Closing Price: $.1044 with recent weekly high of $.1148 and 48.5% total ROI since our coverage began March 27th. Vivos Inc. Innovation in Precision Radionuclide Therapy

Volume Buzz: 3.31M shares traded above 10-day average volume of 774K.

Why Watch: Anticipation of potential new IsoPet clinics and Company confirmed IDE submission final details, Q1 report is being finalized and New Vivos website

EMGE – Emergent Health Corp.

Weekly Highlight: A rebound of 50% off 0.0012 support.

Closing Price: $0.0018

Volume Buzz: Above previous avg volume of 447k to 1.315M avg shares this week.

Why Watch:Annual Report – 04/11/2024 – Fiscal Year ended December 31, 2023 On July 20, 2023, Emergent closed and withdrew its Regulation A Offering that had been filed with the SEC. Market Cap $768,512 – Unrestricted 292,523,596 04/12/2024

Weekly Highlight: Featured in week 13 +233% finding support at .0014 on the 10th up 24.99% into Friday.

Closing Price: $.002 (-10%) from week 13

Volume Buzz: daily avg volume settled from 26M to 2.12M shares this week.

Why Watch: Recent Filings – NT 10-K 04/01/2024 and PRE 14C – 03/26/2024

AHRO – Authentic Holdings, Inc

Weekly Highlight: A continuation from week 14 increase of +50% this week.

Closing Price: $0.0012

Volume Buzz: Steady daily average of 1.43M shares traded

Why Watch: Recent Filings – NT 10-K 04/01/2024 Maybacks Global Entertainment To Launch Universal App and Expand Into Six Major Countries

Honorable mentions:

SPZI+18.33%

BLGO+8.09%

ABQQ+30%

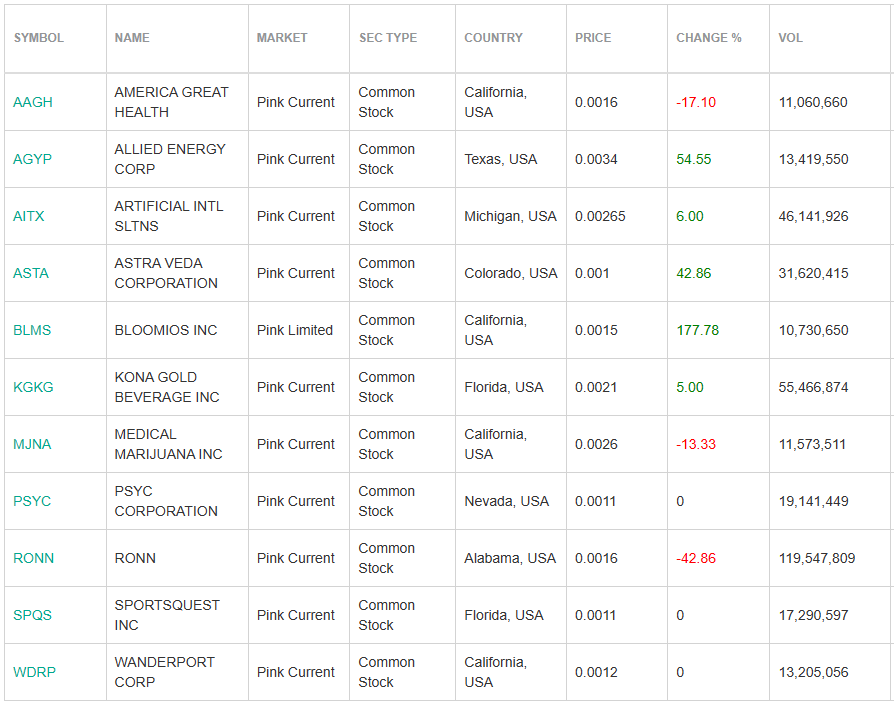

🌟 Screener Highlight of the Week 🌟

Dive into this week’s featured selections from our proprietary screener – where numbers meet intuition. Discover the gems that are shining a bit brighter than the rest.

📈 Criteria Breakdown 📈

Our screener this week zeroes in on stocks with significant price changes, those witnessing unusual trading volumes, entities getting attention in media or social platforms, and companies with noteworthy financial health disclosures. Explore these criteria for potential highlights.

- Price Movements: Stocks with the highest percentage increase/decrease.

- Volume Surges: Companies experiencing unusual trading volume.

- Market Sentiment: Stocks buzzing on social media or news outlets.

- Financial Health Flags: Highlighting companies with recent positive/negative financial disclosures.

🌟 Emerging Opportunities 🌟

Highlighting stocks with promising trends or news that may influence their future success. Our selection of emerging microcap stocks spans various sectors, demonstrating the wealth of opportunities for investors. Below are some notable emerging stocks for consideration. While not all have reached our community watchlist, our commitment is to provide a comprehensive range of microcap investment opportunities to our readers.

- VAALCO Energy Inc. (NYSE:EGY) – Known for its oil and gas ventures, VAALCO has maintained an attractive forward price-to-earnings ratio and strong dividend yield, despite market volatility in energy prices (Yahoo Finance).

- BYD Co. Ltd. (OTCMKTS:BYDDY) – A major player in the electric vehicle market, BYD has received attention for its robust position in a rapidly growing industry, backed by investments from notable figures like Warren Buffett (InvestorPlace).

- Crawford United Corporation (OTCMKTS:CRAWA) – This industrial holding company has shown remarkable growth, successfully implementing a buy-and-grow strategy that has significantly increased its stock value over the years (Yahoo Finance).

- Elite Pharmaceuticals (OTCMKTS:ELTP) – Despite its challenges, Elite Pharmaceuticals could turn around with its new drug applications, promising substantial revenue potential if approved (Yahoo Finance).

- Exro Technologies (OTCMKTS:EXROF) – Specializing in power electronics for electric vehicles, Exro Technologies has shown potential despite recent stock performance dips, with strategic partnerships that could propel future growth (Yahoo Finance).

- MariMed Inc. (OTCMKTS:MRMD) – A cannabis company with consistent profitability and potential as an acquisition target in the event of U.S. federal legalization (Yahoo Finance)

- Ludwig Enterprises (OTCMKTS:LUDG) – Focused on genomic technology, Ludwig offers innovative biotech solutions that could revolutionize healthcare and disease management, presenting a significant growth opportunity in the healthcare industry (PubCo Insight).

📊 Market Trends 📊

For Week 15, the OTC markets displayed consistent activity across various metrics. Throughout the week, a total of 12,436 securities were actively traded each day, reflecting a stable and diverse marketplace for investors.

The average daily dollar volume recorded over the three days was approximately $1.9 billion, computed from individual daily volumes of $2.2 billion, $1.9 billion, and $1.6 billion. This substantial financial activity highlights ongoing investor engagement and capital flow within the OTC markets.

The share volume averaged 4.0 billion shares, calculated from volumes of 3.8 billion and 4.1 billion shares. This significant trading volume demonstrates consistent liquidity and robust investor interest in the OTC market landscape.

The total trades averaged 278,377 per day during the week, with daily counts of 290,379, 283,865, and 260,888. These figures indicate an active and dynamic trading environment, emphasizing the vital role of OTC markets in providing accessibility and liquidity for a broad array of companies not listed on traditional exchanges.

💬 Your Thoughts? 💬

Week 15 saw a subdued pace in the OTC markets, yet it concealed some noteworthy opportunities among the wide array of securities traded. While the overall trading activity was quieter, there was significant financial engagement and a steady increase in monetary flow, suggesting a deepening investor interest in the OTC space. Nonetheless, the quieter market conditions serve as a reminder of the importance of thorough research and prudent risk management when dealing with these less regulated markets. This underscores the potential for discovering hidden gems, albeit with careful strategic consideration.

Missed Week 13’s insights? Catch up here!

Missed Week 14’s insights? Catch up here to stay ahead in the market.

We love hearing from our readers! What are your predictions for next week? Any stocks you’re keeping an eye on? Share your thoughts and let’s engage in the world of OTC stocks together. Join us on X.com