Brazil’s strategic agricultural expansion positions it ahead of the U.S. in global crop markets, enhancing BrasilAgro’s market prospects.

BrasilAgro’s Pending Dominance

As global demand for agricultural commodities intensifies, BrasilAgro (NYSE:LND) is poised to benefit from Brazil’s growing dominance in this sector, characterized by an expansive increase in cropland and record-breaking soybean exports, particularly to the critical Chinese market.

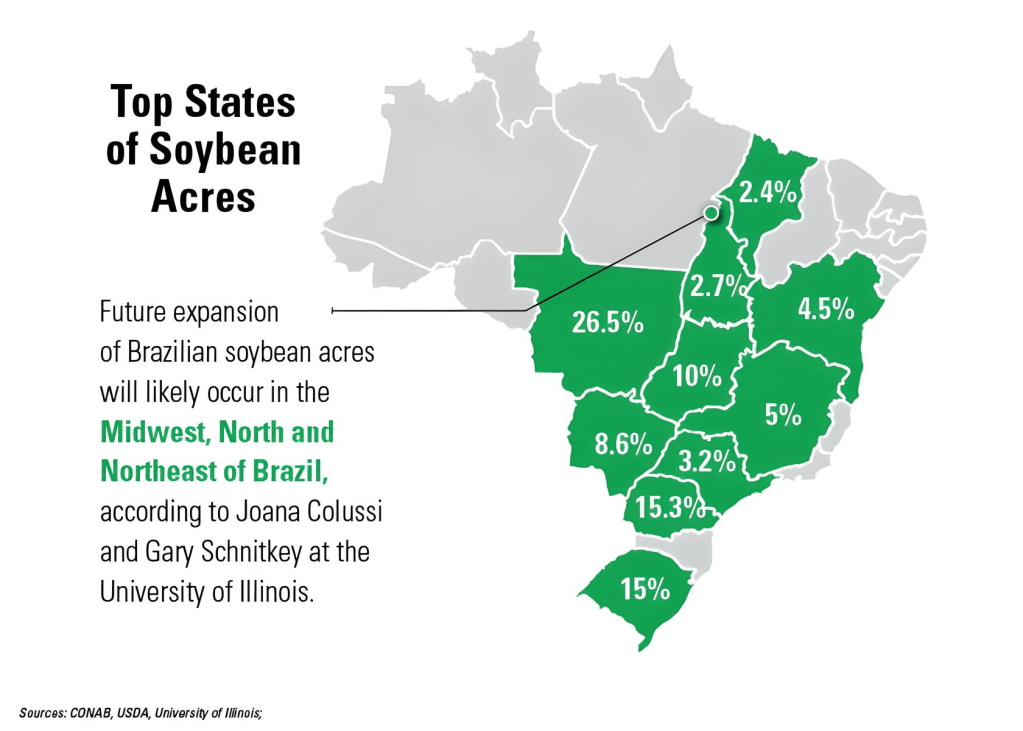

Expanding Agricultural Frontiers

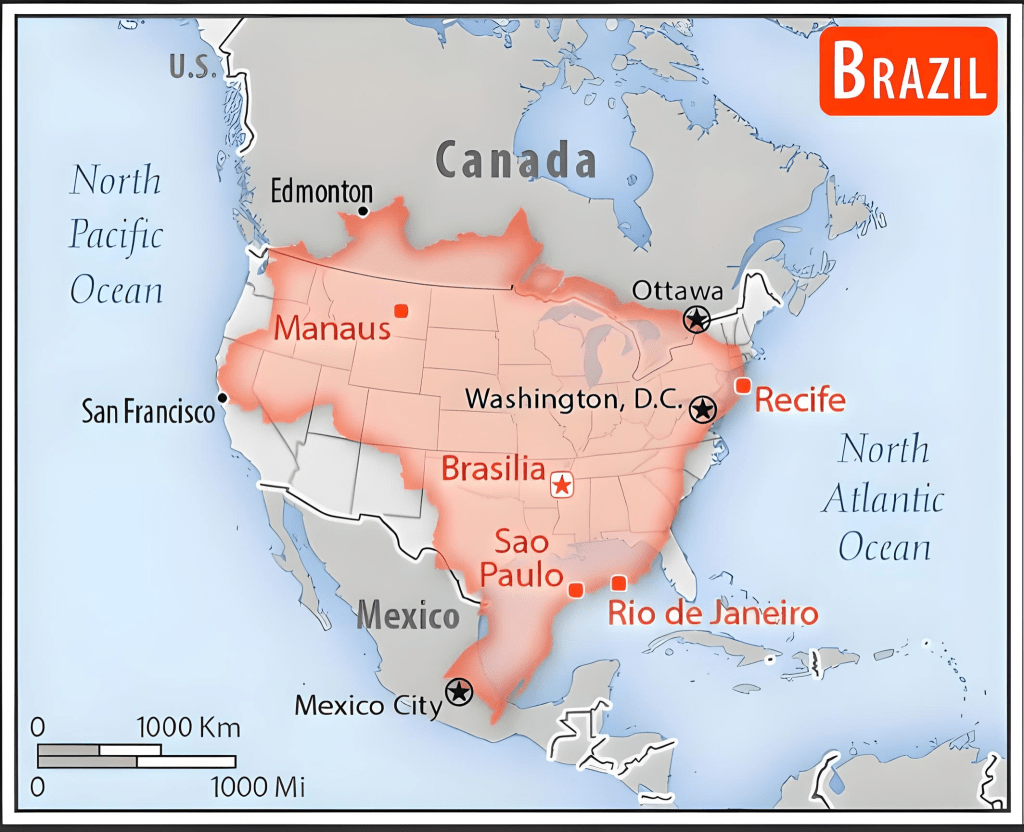

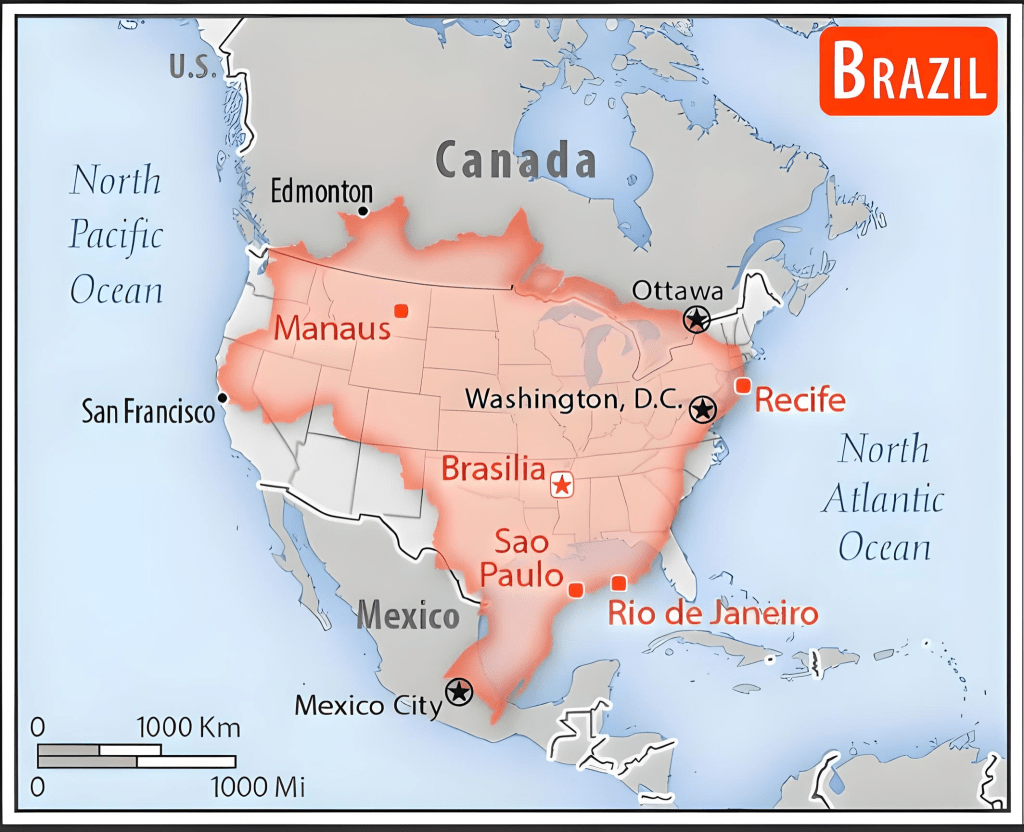

Brazil’s substantial contribution to global cropland expansion, accounting for 27% of the world’s added acreage and 44% within tropical countries, contrasts sharply with the U.S., where harvested acres of key crops have declined. Despite potentially increased U.S. yields due to better farming practices, land area is forever top priority. In the words of Mark Twain, “buy land; I hear they are not making it anymore.” This trend highlights Brazil’s strategic agricultural expansion and sets a robust stage for BrasilAgro to capitalize on these expansions.

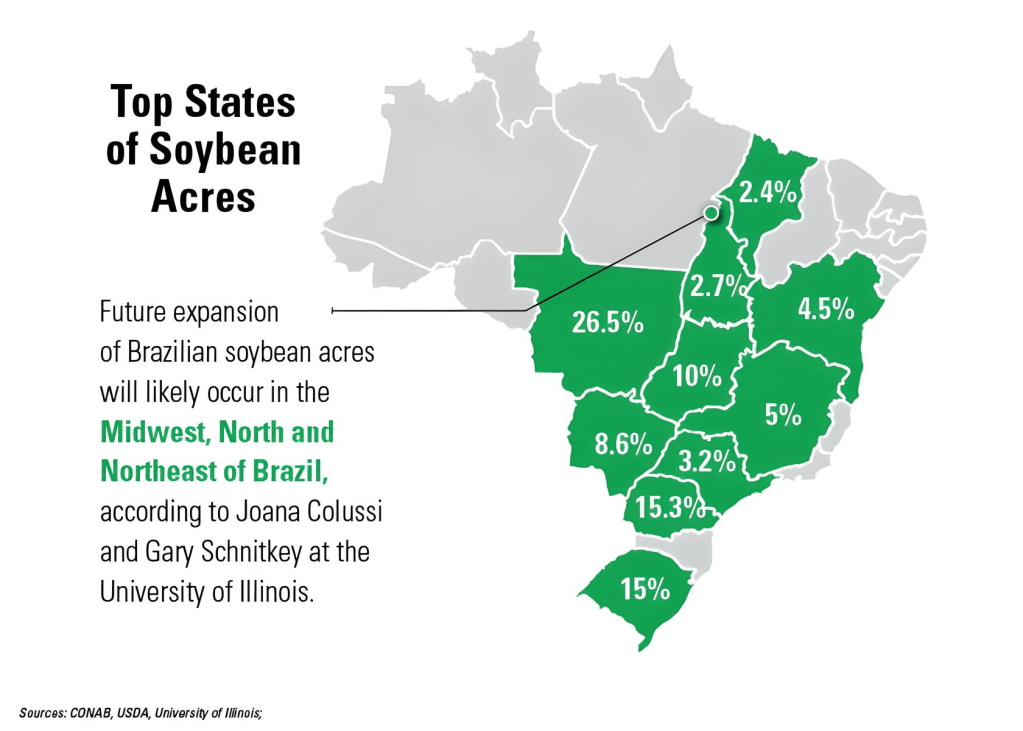

The scale of Brazil’s agricultural land, combined with its strategic development and utilization, positions it as a formidable competitor in the global agricultural sector. While the U.S. has more cropland (~390 million acres), Brazil’s present expansion between 70 – 99 million acres of undeveloped pastureland and efficient use of existing cropland will considerably narrow this gap, eventually amounting to between 251 million – 280 million acres.

Brazil’s ongoing cropland expansion via sustainable practices continues nearly unabated from past commitments, thus ensuring the largest South American country’s top global position, with BrasilAgro on deck to benefit. Moreover, Brazil has begun to expand significant tracts of arable pastureland into productive agricultural land. And as global trading partners and alliances shift due to geopolitical conflicts and transportation costs, Brazil’s agricultural exports will dwarf those of the U.S.

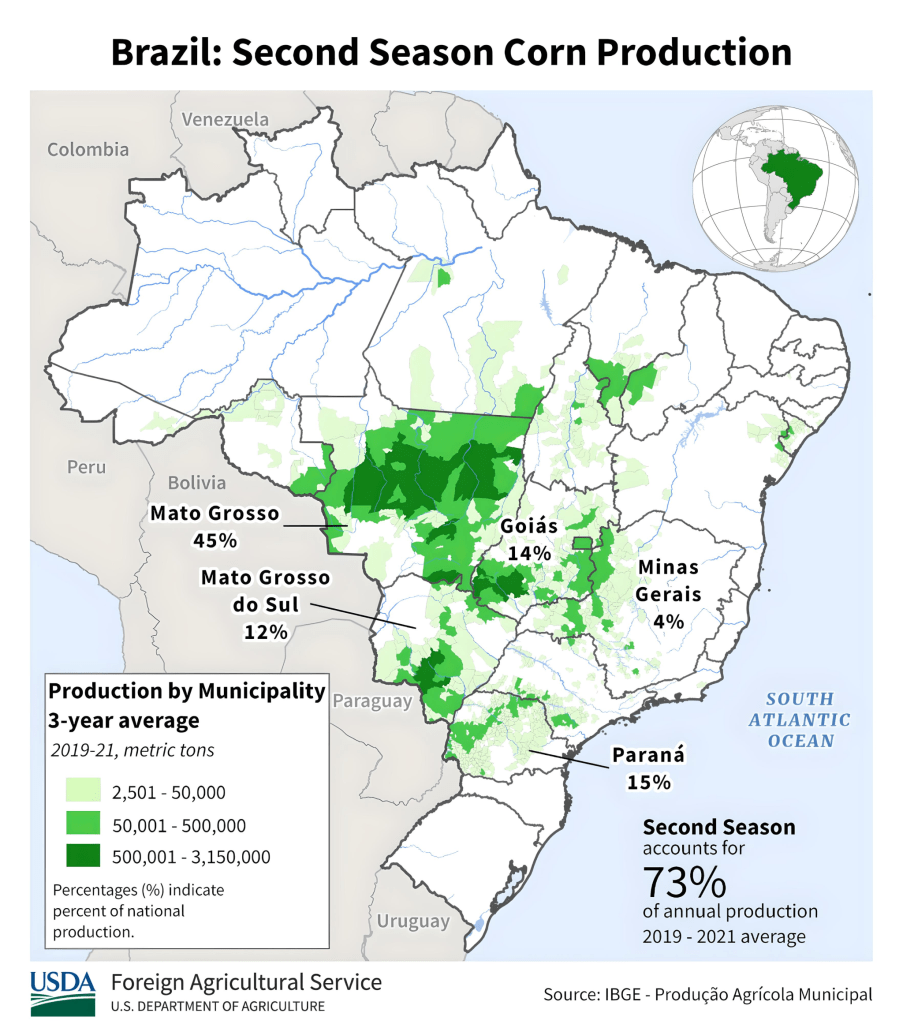

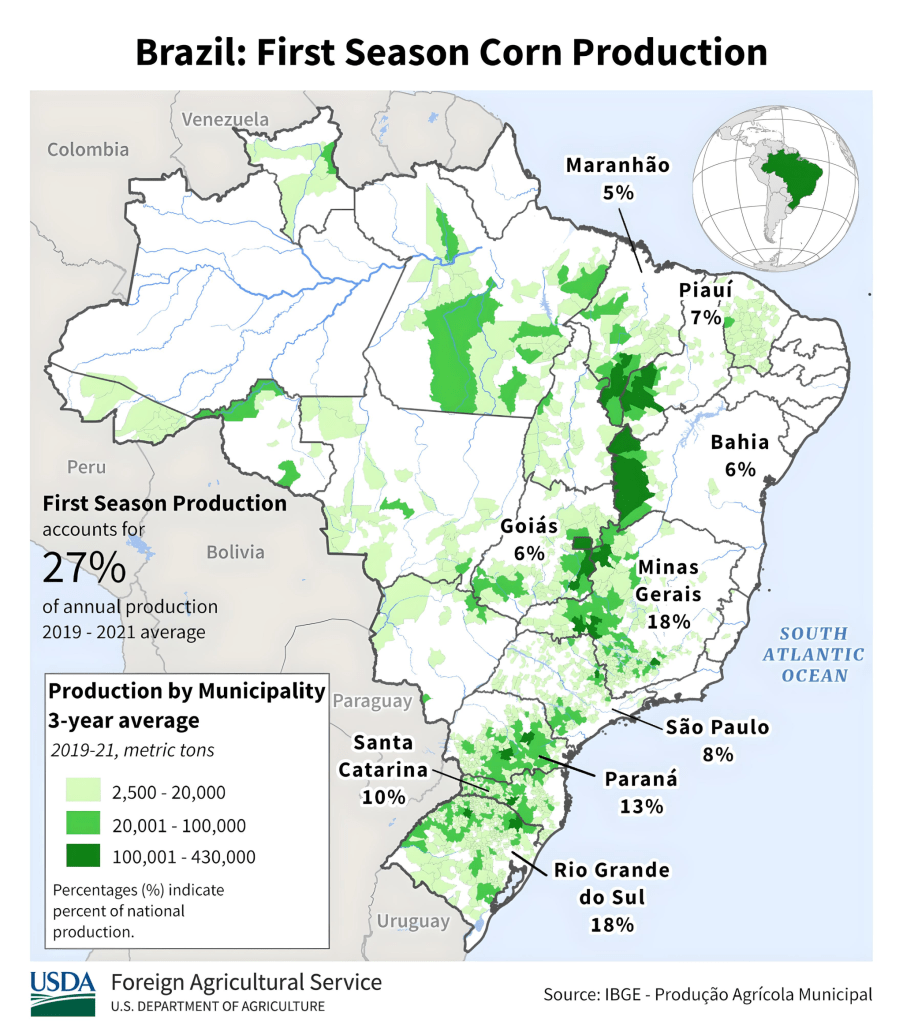

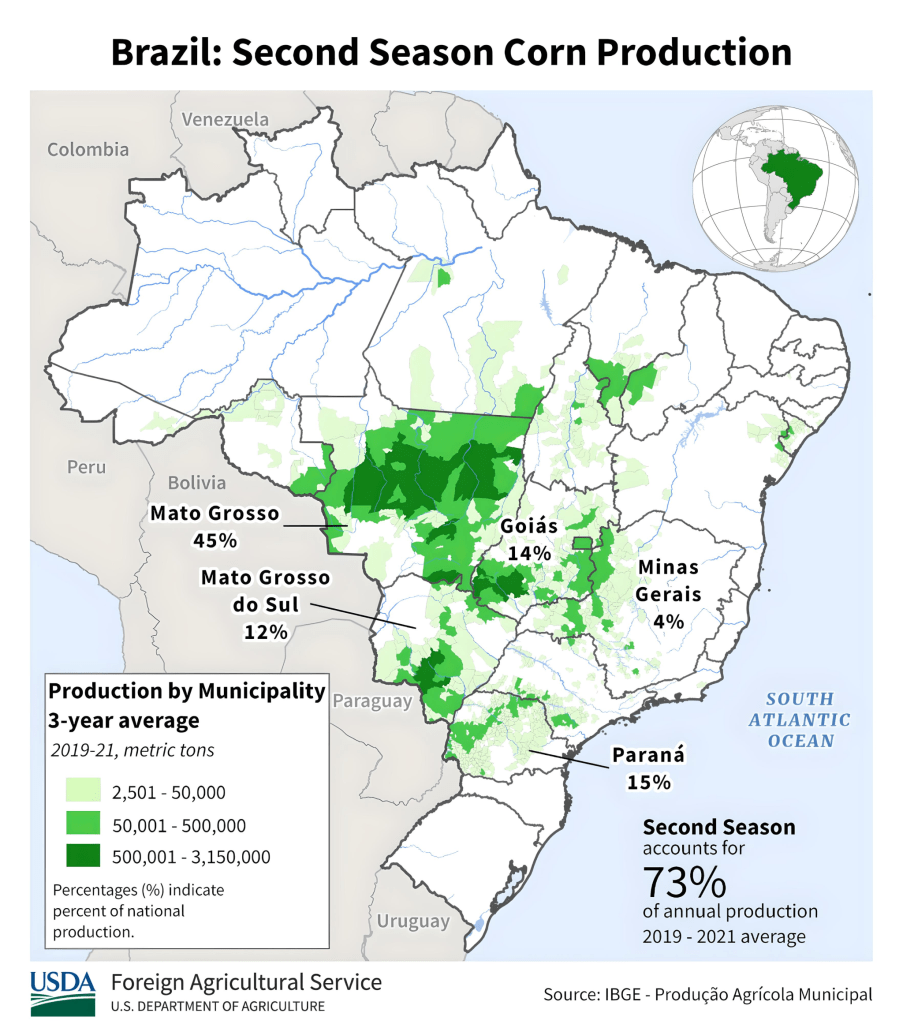

When comparing Brazil to the U.S., the former’s cropland area is about 46% of the United States’ total. However, it’s essential to consider Brazil’s increasing high efficiency primarily via its double cropping approach (i.e., planting two different crops in the same field within a single year), which is prevalent in regions like the most productive Mato Grosso state. This allows the mother country to maximize cropland output, enhancing its role as a key player in global agricultural exports, particularly to China and other Asian markets at the disadvantage of the U.S.

Brazilian Dominance in Global Soybean and Corn Markets

In 2023, Brazil reached a new record in soybean exports, totaling 3,744 million bushels, marking a significant 29% increase from the previous year. This growth not only solidifies Brazil’s position over the United States in the soybean export market but also enhances BrasilAgro’s export capabilities and market reach–and thus its revenues and profits.

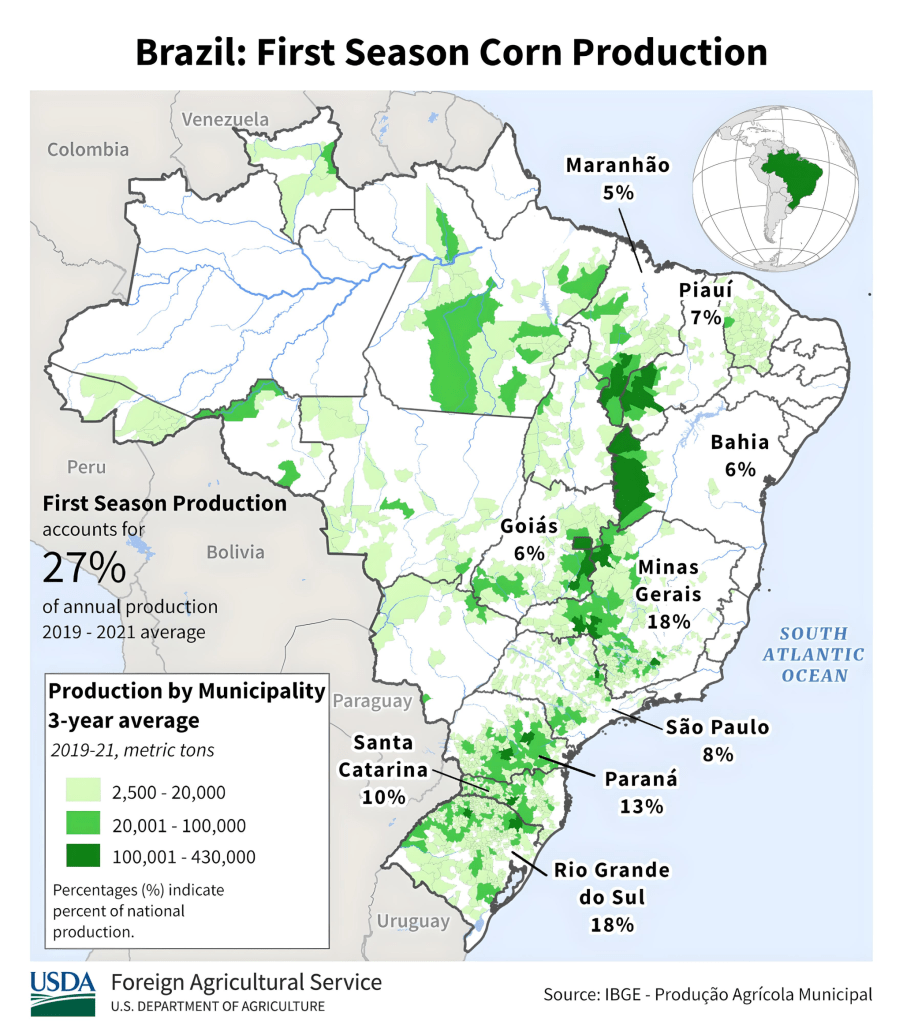

For context, Brazil surpassed the U.S. as the world’s leading corn exporter in August 2023, driven by a record harvest and enhanced logistics from expanded northern export routes utilizing the Amazon River basin. These routes have consistently outperformed traditional ports thanks to significant infrastructure investments that have alleviated longstanding bottlenecks. The source of such investment? China (that, coincidentally, is taking greater stakes in the country, notably its dominant EV company, BYD, that is now operational.

Despite challenges with on-farm storage capacities that lag behind other major grain exporters, modernized transportation routes and significant rail investments are improving the efficiency of Brazil’s grain export logistics. Additionally, strategic developments, including a new major terminal by COFCO in Santos, are set to further strengthen Brazil’s agricultural export capabilities. As Brazil continues to fill gaps left by global market disruptions, its strategic improvements are cementing its position as a top global corn supplier despite forecasted declines in corn production in the near-term in favor of soybean.

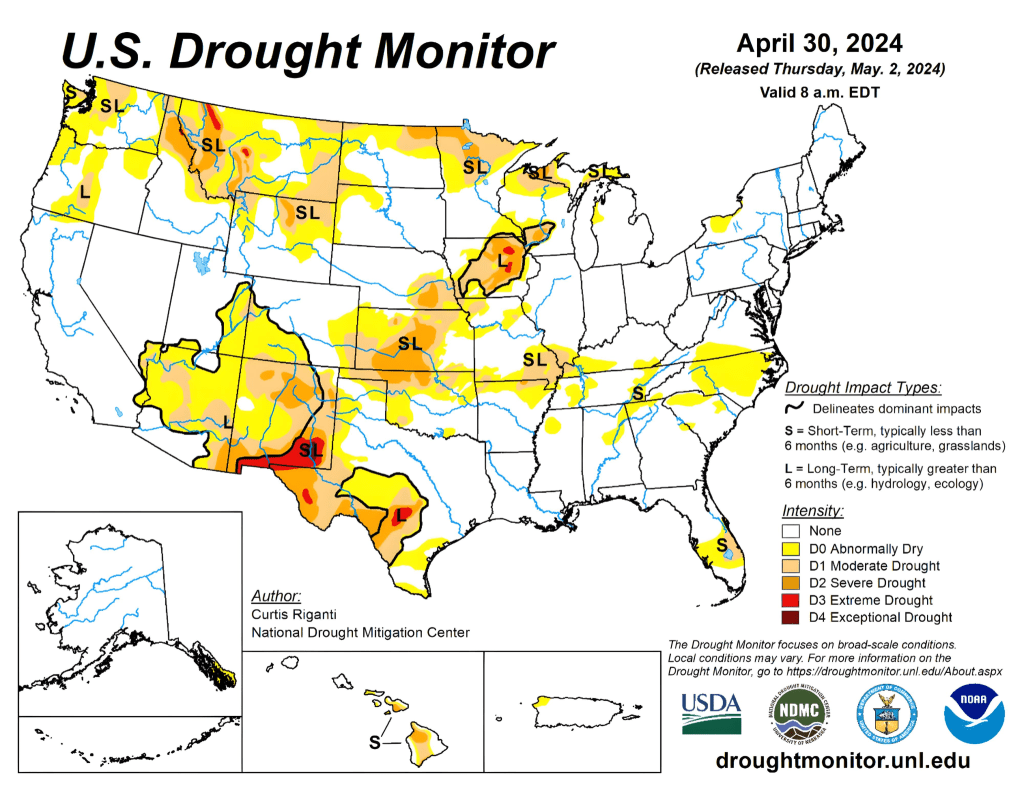

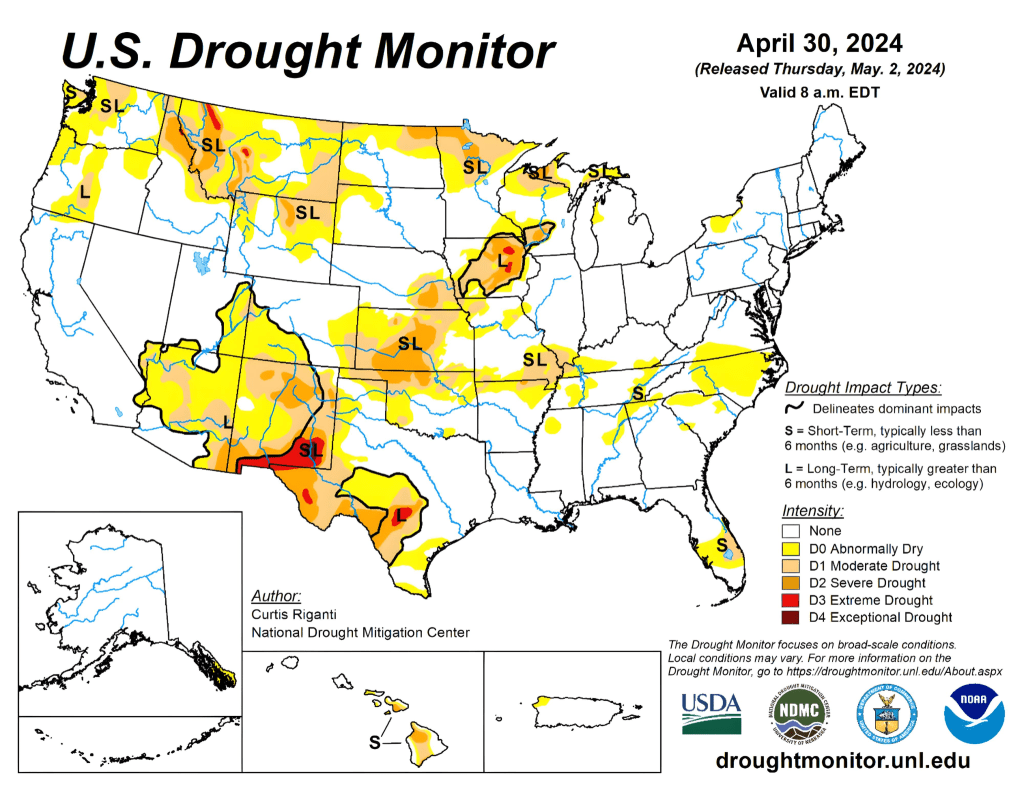

Additionally, continued droughts affecting the U.S. Corn Belt–principally the Mississippi River–will generate higher costs and slower transportation that will adversely affect U.S. exports and thus its revenues and profits that historically have placed the U.S. as the global king of agricultural exports. Likewise, drought worries remain high in the Panama Canal region that drastically affected U.S. grain exports last year.

Leveraging Brazil’s Agricultural Strengths

Brazil’s favorable climate and abundant natural resources also 3provide a competitive edge in commodity production. With the potential to increase its total planted area by 35% through converting degraded pastureland into cropland, Brazil–and, by extension, BrasilAgro, is well-placed to expand production significantly, especially in Mato Grosso, Brazil’s largest agricultural state.

Sustainable Practices and Technological Innovation

BrasilAgro is at the forefront of sustainable agricultural practices, employing no-tillage systems, crop rotations, and integrated crop-livestock-forest systems, including among the country’s conversion of pastureland to cropland. The shift from soybean monoculture to soybean-corn dual cropping, and the potential for double cropping of corn after soybeans, present significant growth opportunities, thereby optimizing land use and boosting productivity. The U.S., on the other hand, continues encountering political and cultural resistance in this regard.

Admittedly, the degraded pastureland intended for expansion is largely derived from previous deforestation–a practice Brazil has considerably mitigated over the past five years, particularly in the Amazon rainforest, which is the most monitored area. Various measures, including stricter enforcement of environmental laws, real-time satellite monitoring, and increased penalties for illegal logging, have contributed to successful sustainability efforts. Reports even suggest Brazil has avoided thousands of square kilometers of deforestation through these interventions.

Strategic Market Positioning and Enhanced Revenue Streams

BrasilAgro’s strategic operations within Mato Grosso and elsewhere position the company to maximize yields and streamline export processes, especially to China, where approximately 60% of all global soybean imports are sourced. The surge in soybean exports has also substantially increased revenue, with Brazil’s revenue hitting a record $53.2 billion in 2023.

Conversely, U.S. soybean and corn exports to China have reduced significantly. In 2023, soybean imports from the U.S. fell by 13% compared to the previous year, highlighting a shift towards sourcing more from Brazil, which saw a 29% increase in its soybean exports to China. This change reflects broader trade dynamics, including Brazil’s increasing dominance in the soybean market and the ongoing impacts of trade tensions between the U.S. and China.

Brazil continues to be China’s top corn supplier and has been since Brazilian vessels first began arriving there in early 2023, pushing out U.S. exports later that year.

Challenges and Future Outlook

Despite the promising expansion, BrasilAgro faces challenges such as rising fuel and fertilizer costs, credit limitations, and logistical hurdles. Recent flooding woes have compromised all crop yields this year, as estimates continue lower via CONAB and USDA FAS.

However, with continued investment in technology and infrastructure, such as precision farming and irrigation, BrasilAgro is setting the stage for a technologically advanced agricultural future in the near-term considering the mother country’s commitment to cropland expansion and a robust trading partnership with China. These initiatives not only enhance efficiency and reduce costs but also align with global trends towards environmental responsibility.

Final Thoughts

The projected expansion of Brazil’s cropland and the strategic initiatives of BrasilAgro in sustainable land management and crop diversification solidify its leadership in the global agricultural market. As the company leverages Brazil’s agricultural advancements, it is well-equipped to seize market opportunities and achieve greater profitability, despite the challenges of volatile market conditions, extreme weather, and geopolitical conflicts. Additionally, the company’s financials presently reveal far more debt than assets in the interim while agricultural expansion ramps up. However, we at TradersQue insist this is a short-term drawback in light of increased agricultural production, yields, and exports spanning soybean, corn, and biofuels–the latter of which China is currently assisting with infrastructure development necessary to compete with the U.S. to scale.

And considering Brazilian sugarcane’s conversion to ethanol fuel renders a 30% less carbon-intensity (CI) score compared to corn-based ethanol–the dominant U.S. input, Brazil will effortlessly accomplish its sustainability goals, including mandatory sustainability reporting from all public companies, its North American peer continues bearing witness to delays and enduring shortcomings in biofuel guidance.

Most recently, the UAE has pledged to invest $13.5 billion USD in Brazilian biofuels, signaling an increasing shift among some Middle Eastern states to shrewdly transition from finite petroleum-based fuels to nearly infinite renewable energy sources and feedstocks. As foreign investments in Brazilian agriculture from major economic powerhouses like China and the UAE continue, the U.S. becomes further relegated to an “outsider looking in” without much potential to depose its South American counterpart.

BrasilAgro’s strategic advantages stem from Brazil’s increasing agricultural dominance, focusing on extensive cropland expansion, record soybean exports, and increased biofuel production aligning more adeptly with global demand and sustainable practices.

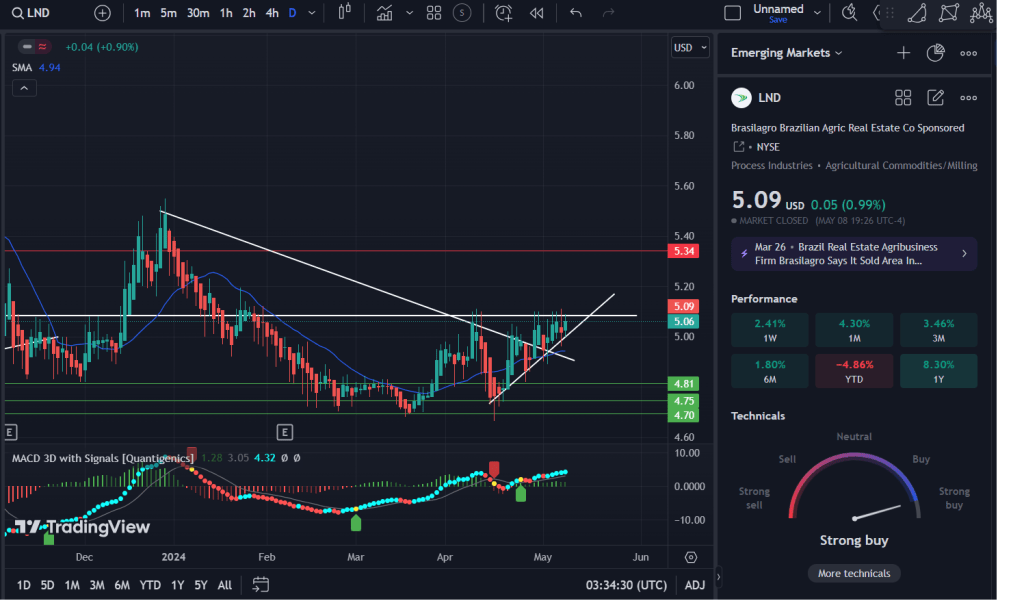

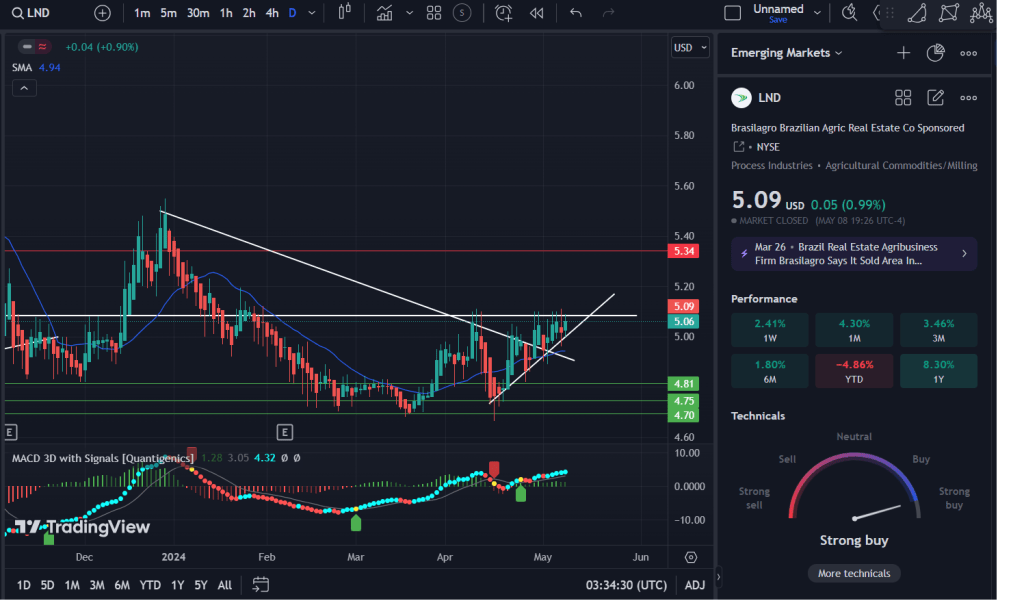

BrasilAgro has a recent history of hard support at the $4.75 USD level with a typical resistance in the low- to mid-$5.00 mark. As of this writing, its price action is following an ascending wedge.

More coverage on Brazil-China-U.S. relations can be accessed via ToddAnalytics’ LinkedIn page dating back to last year.

About BrasilAgro – Companhia Brasileira de Propriedades Agrícolas

BrasilAgro, a major Brazilian agricultural firm, specializes in acquiring, developing, and commercializing agricultural properties. The company targets rural properties with high potential for value generation through advanced agricultural activities, investing in better crops, infrastructure, and technology upon acquisition. BrasilAgro’s operations span several sectors, including Real Estate, Grains, Sugarcane, Livestock, and Cotton. The company manages both its own and third-party assets, engaging in the sale, lease, and intermediation of both rural and urban properties. Founded on September 23, 2005, and headquartered in Sao Paulo, Brazil, BrasilAgro also handles the exploitation, import, and export of agricultural, livestock, and forestry products and inputs.

Expanding Impact Through Subsidiaries and Partnerships

Expanding Impact Through Subsidiaries and Partnerships

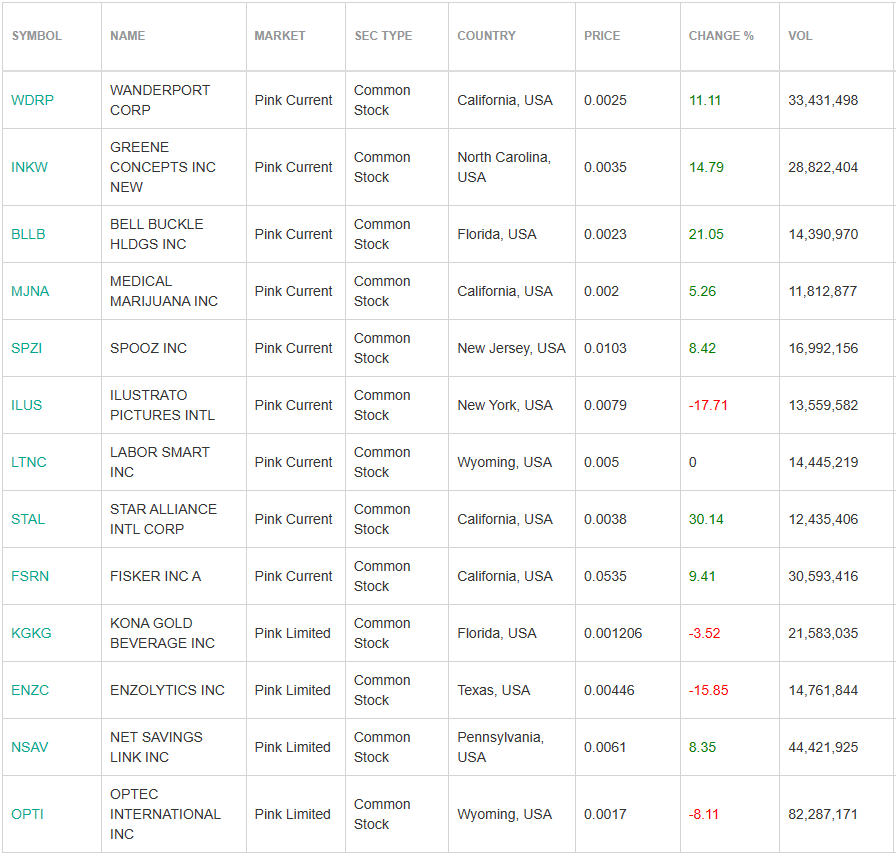

🌟 Screener Highlight of the Week 🌟

🌟 Screener Highlight of the Week 🌟

Analyst Ratings and Stock Performance

Analyst Ratings and Stock Performance Overview of Operational Challenges

Overview of Operational Challenges Strategic Initiatives and Market Expansion

Strategic Initiatives and Market Expansion Final Thoughts and Outlook

Final Thoughts and Outlook

Recent Analyst Actions and Market Sentiments

Recent Analyst Actions and Market Sentiments

Shaping the Future of Quantum Computing

Shaping the Future of Quantum Computing

Snowflake’s Unique Data Solutions

Snowflake’s Unique Data Solutions Financial Performance and Market Position

Financial Performance and Market Position