Diving into NSAV and NSAVx Token’s Technology-Driven Ventures

Explore the innovative world of Net Savings Link, Inc. (NSAV) and its pivotal role in the blockchain and cryptocurrency sectors. With strategic investments and the development of the NSAVx token, NSAV is shaping the future of digital finance, merging technology with user-centric solutions to navigate the complexities of today’s market.

Pioneering Blockchain Innovations

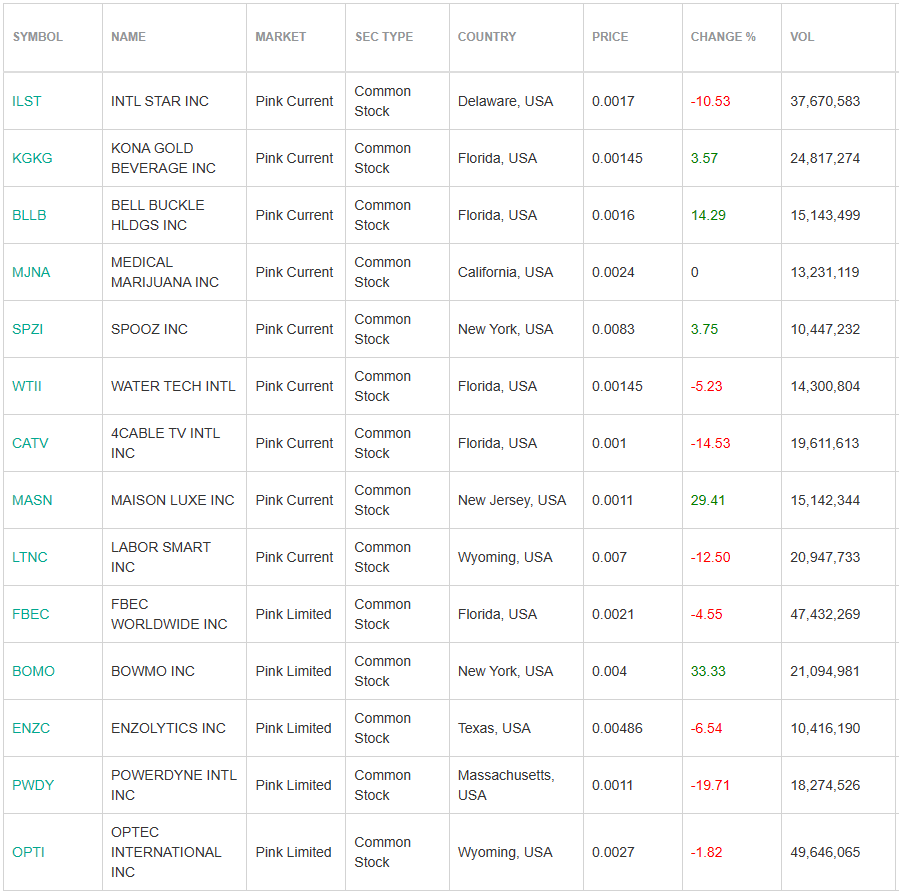

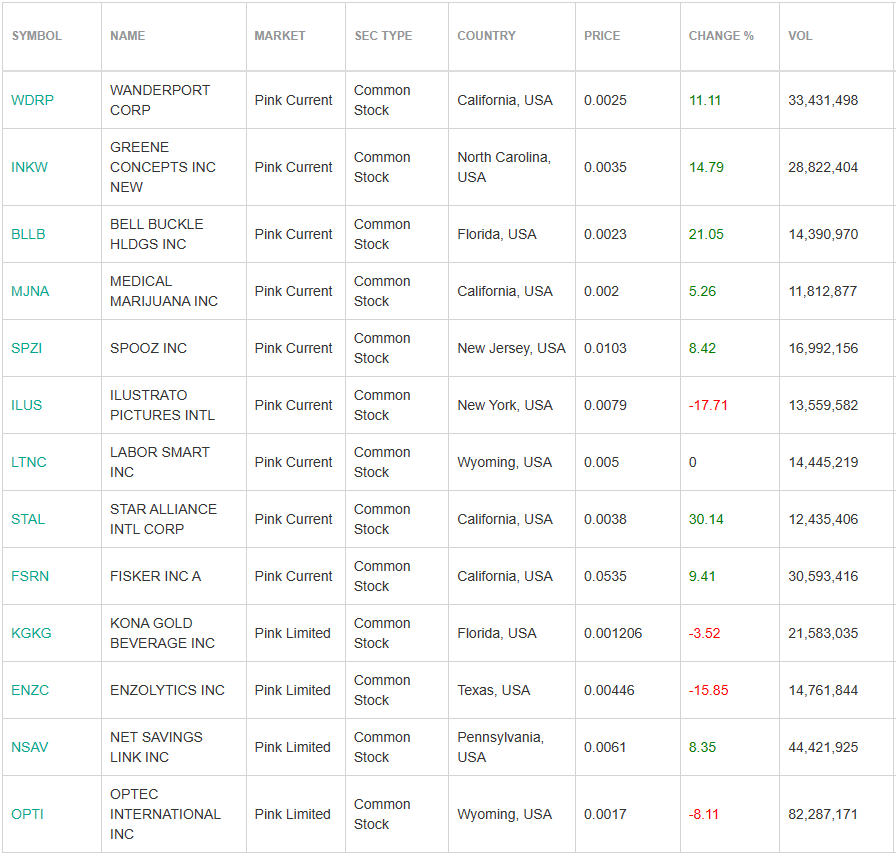

Net Savings Link, Inc. (NSAV) stands at the forefront of the technology sector, primarily focusing on blockchain and cryptocurrency innovations. Operating under the ticker NSAV on the OTC Pink Sheets, the company boasts a market capitalization of approximately $85.7 million and has been a part of the public trading arena since September 2008. NSAV’s commitment extends beyond basic technology offerings to include e-commerce and advisory services, underpinning its diversified approach in a volatile market.

Enhancing Cryptocurrency Exchange Capabilities

Enhancing Cryptocurrency Exchange Capabilities

The ERC-20 NSAVx token is pivotal to the functionality of the NSAVx Centralized Cryptocurrency Exchange (CEX), underpinning a powerful platform for digital transactions. Recent developments, particularly the introduction of the NSAVx staking program, have significantly enhanced the exchange’s capabilities and user engagement.

The staking program, launched recently, offers token holders an attractive incentive, providing rewards ranging from 7% to 10% compounded monthly. This initiative encourages deeper engagement and participation within the NSAVx ecosystem, promoting token liquidity and market stability.

Additionally, NSAV is enhancing its platform’s accessibility with the development of new FIAT onramps and offramps and integrating credit card payment facilities, aiming to cater to a global market. These advancements are designed not only to elevate the user experience but also to secure NSAVx.com’s position as a competitive force in the bustling digital currency exchange arena.

NSAVx.com: Strategic Expansion and Spinoff Potential

Net Savings Link, Inc. (NSAV) has strategically expanded its operations by forming NSAVx.com as a wholly owned subsidiary incorporated in Wyoming, which is authorized to issue 100,000,000 shares of common stock at zero par value. This move facilitates the management of both domestic and international NSAVx.com exchange assets and sets the groundwork for potential future initiatives such as a spin-off as a special dividend to NSAV shareholders. NSAV’s strategic developments not only enhance user base growth but also bolster the potential for monetizing and spinning off its exchange assets in the future. NSAV Announces Formation of NSAVx.com Wyoming and Preliminary Results of MyAirDropAlert Joint-Marketing Campaign

The Strategic Acquisition and Integration of SWOP Token

The acquisition of Swopx.io marks a significant milestone for Net Savings Link, Inc. (NSAV), as it integrates the SWOP token into its growing suite of cryptocurrency solutions. This strategic move not only diversifies NSAV’s asset offerings but also strengthens its position within the cryptocurrency exchange market.

SWOP token, previously affiliated with influential platforms like TrustSwap, brings a robust history of integration within decentralized finance (DeFi) ecosystems. Its capabilities extend from facilitating secure token swaps to enabling staking mechanisms, which have been instrumental in building a more versatile financial environment. The token’s prior integrations include partnerships with major financial networks, allowing SWOP holders to engage in transactions globally using Visa-linked services.

By listing the SWOP token on the NSAVx.com exchange, NSAV is poised to leverage these existing capabilities and introduce innovative financial products that enhance liquidity and market stability. This approach not only broadens the utility of the SWOP token but also aligns with NSAV’s mission to offer comprehensive, technology-driven financial services that address the needs of modern investors and cryptocurrency users.

NSAV Hits Over 500,000 Users on NSAVx.com CEX Exchange

NSAV Hits Over 500,000 Users on NSAVx.com CEX Exchange

Net Savings Link, Inc. (NSAV) has reached a significant milestone, surpassing 500,000 users on its NSAVx.com Centralized Cryptocurrency Exchange (CEX) in partnership with MyAirDropAlert.com (MADA). This achievement marks a substantial expansion in NSAV’s market presence.

Between May 13 and the early hours of May 14, 2024, the platform added 186,819 new accounts, culminating in a total of 535,597 new users from the ongoing marketing collaboration with MADA.

NSAVx.com has also expanded its trading capabilities, now supporting a variety of new cryptocurrencies and multiple fiat currencies for transactions, including USD, GBP, EUR, and more. The platform is currently enhancing its service offerings with the development of new FIAT onramps and offramps, as well as credit card integrations, aiming to meet the diverse needs of its global user base.

NSAV stated, “Reaching 500,000 users is a pivotal moment in our journey. We continue to advance, providing comprehensive technology solutions in the cryptocurrency, blockchain, and digital asset sectors.” This growth underscores NSAV’s goal to evolve into a fully integrated technology company, delivering wide-ranging services from software solutions to advisory services. NSAV Surpasses 500,000 User Mark on NSAVx.com CEX Exchange (yahoo.com)

NSAV SECURITY DETAILS

NSAV SECURITY DETAILS

Share Structure

Financial Projections Based on User Investments at NSAVx.com

With the NSAVx.com user base now exceeding 500,000, analyzing the potential financial impact of different levels of user investment can provide deeper insights into the future market capitalization and growth potential of NSAV. Let’s compare three basic hypothetical investment scenarios: $10, $100, and $1000 per user.

$10 per User

Total Investment: $10 x 500,000 = $5,000,000

For market cap comparison assuming all current users staked, or this total may stake in the future. With an average monthly staking yield of 8.5% compounded, the annual return could significantly amplify this base. Over one year, this could theoretically increase the total investment by approximately 159.7%, leading to a total of about $12,985,000.

$100 per User

Total Investment: $100 x 500,000 = $50,000,000

Using the same assumptions, this results in a total of approximately $129,850,000.

$1000 per User

Total Investment: $1000 x 500,000 = $500,000,000

Continuing the same assumptions, the total value after one year could swell to about $1,298,500,000 in NSAVx holdings.

These projections illustrate the substantial impact that user participation in staking could have on NSAV’s overall financial health and market valuation. The staking incentives not only encourage user retention and engagement but could also significantly enhance NSAV’s market capitalization, making it an attractive proposition for both new and existing investors. The growth in total dollar value and percentage illustrates the scalable potential of NSAV’s market cap, contingent upon active and sustained user investment and participation in staking programs.

Compliance and Regulatory Focus

Compliance and Regulatory Focus

Net Savings Link, Inc. (NSAV) is deeply committed to enhancing its compliance and regulatory framework. The company is actively engaged with OTC Markets to achieve Pink Current status, an indicator of transparency and adherence to requisite financial reporting standards. This effort underscores NSAV’s dedication to upholding high compliance standards, which is pivotal in fostering investor trust and maintaining integrity in the competitive digital finance landscape. Achieving Pink Current status will not only bolster NSAV’s credibility but also strengthen its position as a reliable and trustworthy entity in the blockchain and cryptocurrency sectors. NSAV Holding @NSAV_Tech $NSAV shareholders have no reason to be concerned regarding our status with OTC Markets. It has all been taken care of. Thank you.

NSAV – Net Savings Link, Inc. | Disclosure | OTC Markets

NSAV’s Forward-Thinking in Blockchain Realm

NSAV Holding’s vision is the establishment of a fully integrated technology company, which provides turnkey technological solutions to the cryptocurrency, blockchain and digital asset industries. Over time, the Company plans to provide a wide range of services such as software solutions, e-commerce, financial services, advisory services and information technology.

NSAV continues to make waves in the blockchain and cryptocurrency sectors with strategic acquisitions, token integrations, and a focus on technological advancements. Its ability to navigate the complexities of digital finance with innovative solutions positions NSAV as a key player in the evolving tech landscape.

The NSAV Centralized Cryptocurrency Exchange (CEX)

https://nsavx.com/

The AirdropX.co website

https://www.airdropx.co/

The NSAVx Token website

https://www.nsavxtoken.com/nsavx-token

The NSAVx Discord Server

https://discord.com/invite/7Q2Vv5NmKd

The NSAV Twitter account

https://twitter.com/nsav_tech

The NSAV corporate website

http://nsavholdinginc.com

💥

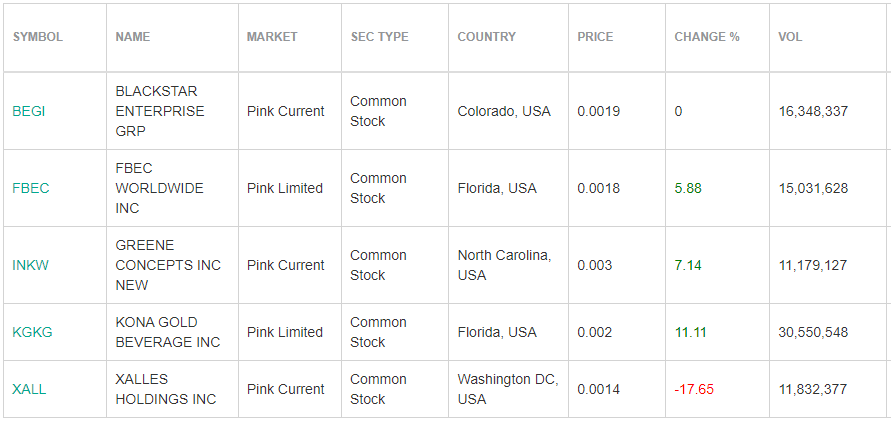

💥  🌟 Screener Highlight of the Week 🌟

🌟 Screener Highlight of the Week 🌟

Expanding Impact Through Subsidiaries and Partnerships

Expanding Impact Through Subsidiaries and Partnerships

🌟 Screener Highlight of the Week 🌟

🌟 Screener Highlight of the Week 🌟

Analyst Ratings and Stock Performance

Analyst Ratings and Stock Performance Overview of Operational Challenges

Overview of Operational Challenges Strategic Initiatives and Market Expansion

Strategic Initiatives and Market Expansion Final Thoughts and Outlook

Final Thoughts and Outlook

Recent Analyst Actions and Market Sentiments

Recent Analyst Actions and Market Sentiments

Shaping the Future of Quantum Computing

Shaping the Future of Quantum Computing

Snowflake’s Unique Data Solutions

Snowflake’s Unique Data Solutions Financial Performance and Market Position

Financial Performance and Market Position